In South Africa’s vehicle market, there’s a noticeable shift towards more affordable ownership options, as indicated by TransUnion’s Vehicle Pricing Index (VPI) for the third quarter of 2023. CEO Lee Naik highlighted that dealerships are offering significant discounts and incentives, while banks are extending loan terms. Financially distressed consumers are increasingly turning to older, lower-cost used vehicles, facilitated by alternative financing solutions and trade support from dealerships.

Extended Finance Terms: Considerations for Consumers

While longer finance terms, up to 84 months, are being offered with no balloon payment option, consumers must carefully assess their financial situation before committing. In longer-term loans, the faster depreciation of vehicles in the initial years could result in potential financial challenges. It’s crucial for consumers to weigh the benefits of lower monthly payments against the overall cost and depreciation of the vehicle.

Economic Challenges Impacting Vehicle Affordability

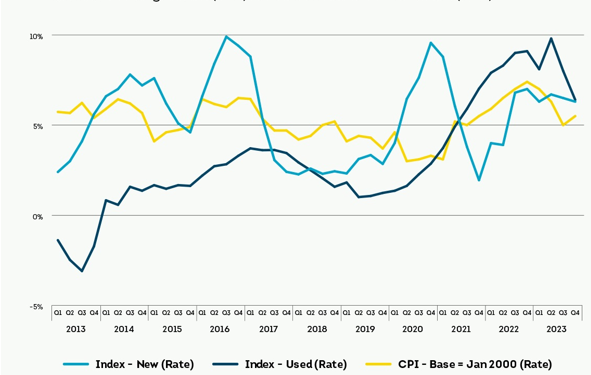

Inflation and economic constraints are rendering vehicle ownership unattainable for many South Africans. Lower-income consumers represent a shrinking portion of financed vehicles, with a notable decrease in vehicle financing between Q3 2022 and Q3 2023. Loan delinquency rates have also increased, reflecting the financial strain faced by consumers.

Market Dynamics: New Cars vs. Used Cars

The South African vehicle market has tilted in favor of new cars, with the used-to-new ratio decreasing significantly. This shift is attributed to various factors, including rising used vehicle prices, stock pressures, and attractive deals on new cars. Dealerships are responding to market forces by offering substantial discounts on new vehicles, stimulating sales and benefiting consumers.

Impact on Vehicle Segments and Pricing Strategies

Certain segments of the used car market are experiencing significant price hikes, with midsize SUV prices rising notably. This trend is influenced by supply pressures and increased demand for specific vehicle types. Additionally, the introduction of new entry-level models from both established OEMs and Chinese brands is reshaping the market landscape. Dealerships are adopting pragmatic pricing strategies, aligning with market dynamics to drive sales and provide consumers with unprecedented opportunities.

Conclusion

South Africa’s vehicle market is undergoing a transformative phase characterized by a shift towards more affordable ownership options, extended finance terms, and evolving market dynamics favoring new cars. While economic challenges persist, dealerships are adapting their strategies to meet consumer demands and stimulate sales, ultimately reshaping the landscape of vehicle ownership in the country.