Looking to save money on buying a car in South Africa? Repossessed vehicles can offer significant savings, often priced 10–20% below retail value. These cars are sold by banks or auction houses after being reclaimed from owners who defaulted on loans. However, they come with risks, as they are sold "as-is" without warranties. Here’s what you need to know:

- Where to Buy: Explore bank auctions (Absa, FNB, Nedbank, Standard Bank), auction houses (Bidvest Burchmores, Aucor, Park Village), or online platforms like AUTO24.co.za and GoBid.

- What to Check: Inspect the car’s history via its VIN, verify documentation, and conduct a physical inspection with a mechanic. Watch for hidden repair costs.

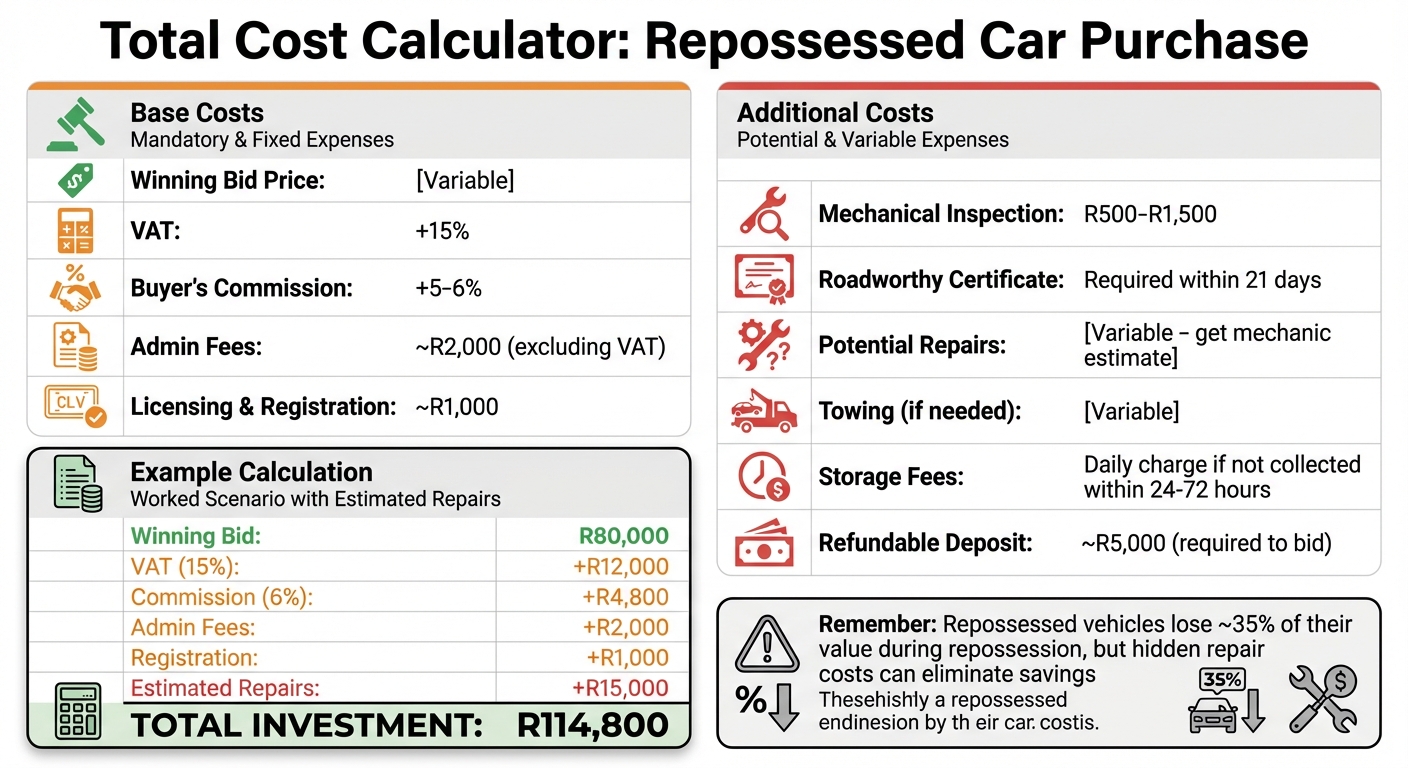

- Costs: Beyond the bid price, account for VAT (15%), buyer’s commission (5–6%), admin fees (~R2,000), and potential repairs.

Repossessed cars are ideal for buyers with mechanical know-how or access to a trusted mechanic. But if you’re seeking a worry-free vehicle, consider certified pre-owned options instead.

BUYING BANK REPOS FROM AUCTIONS

Where to Buy Repossessed Cars in South Africa

If you’re looking to buy repossessed cars in South Africa, there are three main options to explore.

Banks and Financial Institutions

Major banks like Absa, FNB, Nedbank (MFC), and Standard Bank sell repossessed cars through auction houses, trade centers, or online platforms.

- Absa has trade centers in cities like Boksburg, Bloemfontein, Durban, Port Elizabeth, and Cape Town. They partner with auction houses such as Tirhani, Park Village, and Bidvest Burchmores.

- Standard Bank works with a wider network that includes Aucor, Motus, MyCars, and Liquidity Services.

- FNB offers both online and in-person auctions across the country, allowing buyers to apply for vehicle financing on their repossessed stock.

- Nedbank’s MFC runs dedicated auction facilities with on-site finance and insurance consultants to assist buyers.

To participate, you’ll need to provide FICA documents (ID and proof of residence) and a refundable deposit of about R5,000. Banks typically allow you to inspect vehicles and start the engines during viewing days, but test drives are not permitted. If you win a bid, you’ll have three working days to pay the full amount and collect the car.

If auctions through banks aren’t your preference, auction houses are another popular choice.

Auction Houses

Auction houses handle a significant portion of repossessed vehicle sales. Some of the key players include:

- Bidvest Burchmores: Weekly auctions in Midrand, Cape Town, and Durban.

- Aucor Auctioneers: Regular Saturday auctions for Absa and Standard Bank.

- Park Village: Nationwide webcast auctions.

- Tirhani Auctioneers: Live and online vehicle sales.

- MyCars: A dedicated platform for Standard Bank’s repossessed vehicles.

Make sure the auction house is officially partnered with the bank. Standard Bank, for instance, warns buyers to avoid unlisted sellers. Legitimate auction houses provide clear "Rules of Auction" documents and charge transparent fees. Expect to pay the bid price, 15% VAT, a buyer’s commission, and documentation fees of around R2,500 per vehicle.

Be cautious of scams – official auction houses never ask for upfront fees to "secure" a car outside the formal process. If you’re new to auctions, attend a few as an observer to get familiar with the process before you start bidding.

For those who prefer more transparency and time for inspections, dealerships and online platforms offer alternative solutions.

Dealerships and Online Platforms

Some dealerships and online platforms sell repossessed cars at clear, upfront prices. For example:

- AUTO24.co.za: With locations in Gauteng (Johannesburg) and Cape Town, this platform provides inspection options and straightforward pricing for used and repossessed cars.

- GoBid: Specializes in fleet, insurance, and private bank stock.

These options often allow more thorough inspections compared to traditional auctions. However, cars are still sold under the voetstoots principle – "as is", with no warranty. While prices on these platforms may be slightly higher than at auctions, the added convenience and inspection time can be worth it.

No matter where you choose to buy, remember to budget for additional costs beyond the sticker price. These include VAT, buyer’s premiums, administration fees, and the cost of a roadworthy certificate, which is legally required within 21 days of purchase. It’s a good idea to bring a qualified mechanic to inspect the car and verify the Vehicle Identification Number (VIN) to ensure its legitimacy. These steps can help protect your investment and avoid unexpected surprises.

What to Check Before Buying a Repossessed Car

Complete Cost Breakdown for Buying Repossessed Cars in South Africa

When it comes to repossessed cars, thorough checks are key since these vehicles are sold as-is. Typically, test drives aren’t allowed, and previous owners might have skipped routine maintenance. This makes it critical to verify everything carefully before making a purchase. One of the first steps is to dig into the car’s history and ensure all documentation is in order.

Vehicle History and Documentation

Start by running the Vehicle Identification Number (VIN) through a trusted VIN verification service. This will confirm the car isn’t stolen and can uncover important details like accident history and whether the mileage is accurate. Be sure to check for any unpaid fines tied to the VIN, as these could cause problems when registering the car.

If you win the bid, you’ll need to collect a tax invoice, sale receipt, and release note from the auction house – these documents are crucial for legally taking possession of the vehicle. Also, check if the manufacturer’s warranty or service plan is still valid. After sorting out the paperwork, the next step is a professional physical inspection.

Physical Inspection

Have a qualified mechanic inspect the car during the viewing. Take a close look at the vehicle yourself, too. Walk around it and check door alignment and body panels – uneven gaps or inconsistencies could hint at past accident damage. Pay attention to the paintwork; mismatched colors or overspray in areas like the engine bay are telltale signs of non-factory repairs.

Look underneath the car for any obvious leaks, whether oil or water. While auction houses may provide a Dekra report or a fault list, don’t rely on these alone. A professional inspection will give you a more complete picture. Lastly, confirm that the VIN on the chassis and engine matches the documentation and shows no signs of tampering.

Costs and Additional Fees

Don’t forget to calculate the total cost, which goes beyond just the winning bid. You’ll need to account for 15% VAT, a buyer’s commission of 5–6%, and administration fees starting at R2,000 (excluding VAT). Licensing and registration transfer costs usually add around R1,000.

Once you’ve won the vehicle, make arrangements to collect it within 24 to 72 hours to avoid daily storage fees. If the car isn’t drivable, you’ll need to organize towing. Keep in mind that repossessed vehicles often lose about 35% of their value during the repossession process. Without a proper inspection, any hidden repair costs could eat into those savings quickly.

sbb-itb-09752ea

Tips for Managing Risks and Setting Realistic Expectations

When it comes to buying a repossessed car, it’s important to recognize the risks involved and set practical expectations. These vehicles are sold strictly as-is. That means the responsibility for evaluating the car’s condition and identifying potential issues rests entirely on you.

Assessing Condition and Repair Costs

To get a clear picture of the total cost, you’ll need to factor in several expenses beyond the winning bid. Start by adding 15% VAT, a 5–6% commission, and administration fees (which can exceed R2,000). On top of that, include the cost of any necessary repairs, as determined by your mechanic during the vehicle inspection. For instance, if your winning bid is R80,000 and repairs are estimated to cost R15,000, your total investment will be R95,000. Compare this against dealership prices for similar models to decide if you’re truly getting a good deal.

If the vehicle still has a manufacturer’s warranty or service plan, that could save you some money on repairs. However, keep in mind that most repossessed cars are sold as-is, so a thorough cost evaluation is critical. These calculations will help you determine whether buying a repossessed car is worth it.

Who Should Consider Repossessed Cars?

Repossessed cars are a better fit for buyers who have some mechanical know-how or can bring an experienced mechanic to the inspection. If you’re comfortable identifying potential issues and have the time to research the car’s history using the VIN, you’re more likely to find a worthwhile deal. These vehicles are ideal for those willing to accept a bit of uncertainty. But if you’re looking for a reliable, hassle-free daily driver, you might be better off with a certified pre-owned car that comes with a warranty.

On the other hand, repossessed cars may not be the best choice if you’re working with a tight budget and can’t afford unexpected repair costs. Financial struggles often lead previous owners to skip maintenance, leaving behind deferred repairs. First-time buyers or those unfamiliar with auctions should also approach with caution. Attend a few auctions as an observer to get a feel for the process and bidding dynamics before jumping in.

Conclusion

Buying a repossessed car in South Africa can be a smart way to save money – if you go into the process well-prepared. Major banks and established auction houses are great starting points, often offering vehicles priced 10% to 20% below retail value. That’s a solid opportunity to stretch your budget. But here’s the catch: every repossessed car is sold as-is, meaning there’s no warranty or option for returns.

This makes a detailed inspection absolutely crucial. Bring along a trusted mechanic to check the engine, bodywork, and overall condition. It’s also wise to verify the car’s history and watch for red flags, like misaligned panels or over-spray in the engine bay, which could indicate past accidents. Don’t overlook additional costs like auction fees or repairs when calculating your total investment.

To sum it up, repossessed cars are best suited for buyers who have some mechanical expertise – or at least access to someone who does – and who are ready to handle potential repair costs. If you’re willing to do your homework and manage the risks, you can score a great deal. However, if you’re after a low-maintenance, worry-free vehicle, a certified pre-owned car with a warranty might be a better fit.

FAQs

What should I watch out for when buying a repossessed car in South Africa?

Buying a repossessed car might seem like a budget-friendly choice, but it’s important to weigh the risks before diving in. These cars are typically sold “as-is”, which means no warranties are included, and in most cases, you won’t get the chance to take them for a test drive. That leaves you relying on a quick inspection, which might not reveal hidden damage or mechanical problems that could lead to expensive repairs down the line.

You’ll also want to factor in extra fees that can sneak up on you. Things like registration costs, auctioneer commissions, VAT, or even storage charges can quickly add up, eating into the savings you thought you’d get. Another challenge? Ownership and service histories are often incomplete, making it tough to determine if the car has been in an accident or undergone significant repairs. And keep in mind, repossessed vehicles may lose value faster, which could hurt you if you plan to sell it later.

To avoid unpleasant surprises, take the time to inspect the car carefully, check its records, and account for all potential costs in your budget before making a final decision.

How can I check the history of a repossessed car before buying it?

To check the history of a repossessed car, start by obtaining the Vehicle Identification Number (VIN). Use it to request a detailed history report from a reliable South African provider. This report will reveal key details like past owners, accident history, mileage discrepancies, and whether the car has a clear title or any outstanding finance.

Next, ask the bank or auction house for the original repossession documents and the "as-is" (Voetstoots) declaration. These will confirm that the loan tied to the car has been settled and no financial claims remain. Double-check that the VIN listed in the auction catalog or sale listing matches the VIN on the actual vehicle.

Lastly, inspect the car yourself or hire a trusted mechanic to thoroughly assess its condition. Be on the lookout for signs of tampering, hidden damage, or mismatched parts. Also, verify that the registration documents can be transferred without issues. By combining a detailed history check, repossession paperwork, and a thorough physical inspection, you can make a more confident and secure purchase.

What extra costs should I plan for when buying a repossessed car?

When buying a repossessed car, it’s crucial to consider expenses beyond just the sale price. These can include auction fees like the buyer’s commission, document fees, and sales tax. Don’t forget to account for registration and title transfer fees, a roadworthiness inspection, and insurance premiums as well.

Since repossessed vehicles are usually sold "as-is", you might need to set aside funds for potential repairs or maintenance after the purchase. Other costs to keep in mind are clearing any outstanding traffic fines, paying storage fees, or covering buyer’s insurance if the auction requires it. Planning for these expenses upfront can help you stick to your budget and avoid any unpleasant financial surprises.

Related Blog Posts

- Where to buy safe used cars in South Africa

- Avoid scams when buying used cars in SA

- Hidden Costs When Buying a Used Car in South Africa

- The Pros and Cons of Buying a Repossessed Car in SA