New car prices in South Africa have been increasing due to economic challenges, currency instability, and supply chain issues. Here’s a quick summary of the key drivers behind these rising costs:

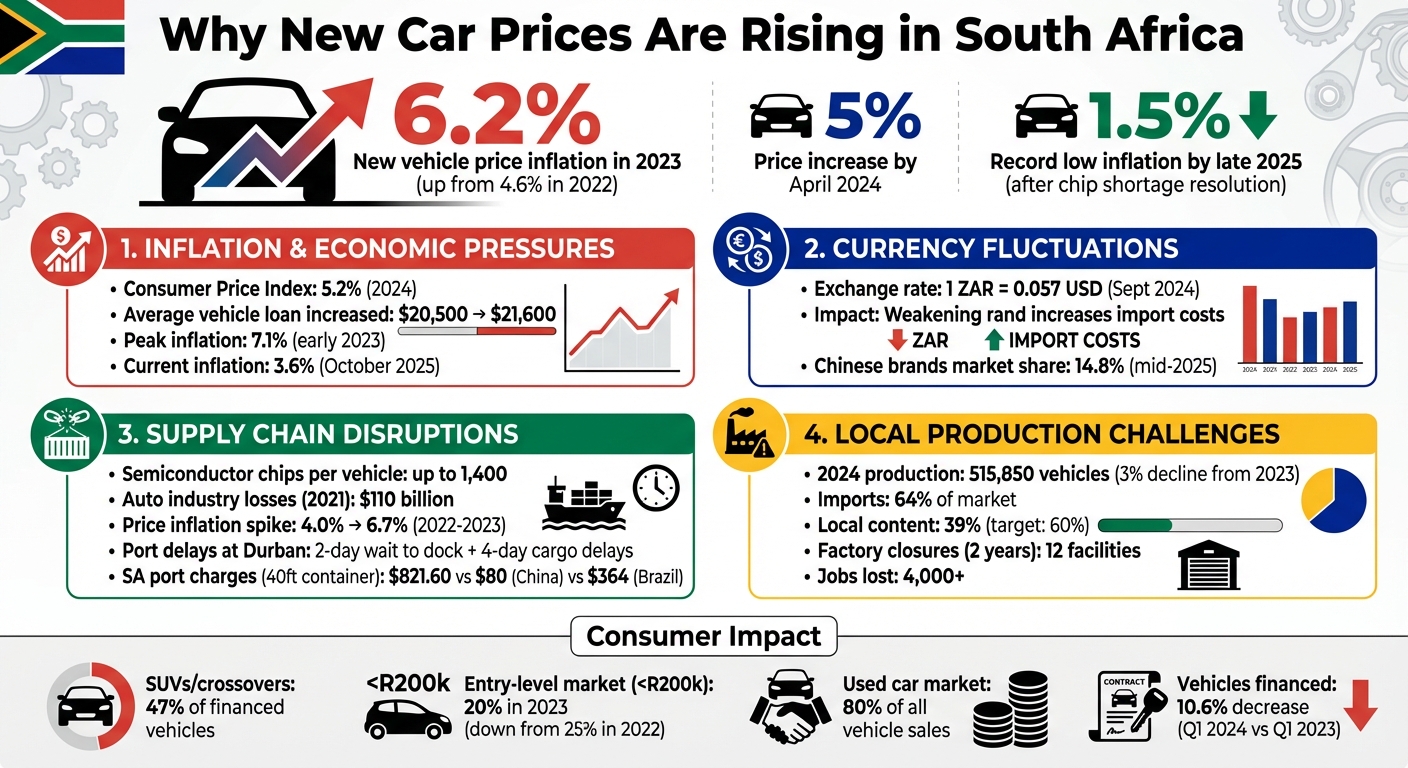

- Inflation: New vehicle price inflation hit 6.2% in 2023, up from 4.6% in 2022, with production costs rising due to higher raw material, labor, and energy expenses.

- Currency Fluctuations: A weakening rand has made importing vehicles and parts more expensive, further driving up prices.

- Supply Chain Disruptions: Semiconductor shortages, shipping delays, and port inefficiencies have limited vehicle availability, leading to higher prices.

- Local Production Challenges: Power outages, high labor costs, and reliance on imported parts have increased manufacturing expenses.

These factors have made car ownership less affordable, pushing many buyers to opt for value brands, used cars, or alternative financing options like subscriptions and leasing.

Key Factors Driving New Car Price Increases in South Africa 2022-2025

Why Are New Cars So Expensive In South Africa?

How Economic Pressures and Inflation Affect Car Prices

South Africa’s automotive market is grappling with a mix of challenges, and inflation is playing a major role in driving up vehicle costs. In 2023, new vehicle price inflation rose to 6.2%, up from 4.6% in 2022. By April 2024, this trend continued, with prices increasing around 5%, closely mirroring the Consumer Price Index (CPI) of 5.2%.

Andrew Hibbert, Auto Data Analyst at Lightstone, explained the connection between these trends:

"The projected outlook for new vehicle price inflation for 2024 is 5%, close to the likely Headline CPI average of 5.1%".

This steady rise in inflation has set the stage for the cost pressures discussed below.

How Inflation Drives Up Costs

Inflation affects every step of car manufacturing. As prices for raw materials, production inputs, and transportation climb, manufacturers face higher costs. In early 2023, when headline consumer price inflation hit 7.1%, automakers felt the pinch across their supply chains. Rising fuel prices, energy costs, and shipping expenses forced manufacturers to adjust retail prices to protect their margins. This impact is evident in the average vehicle loan amount, which increased from $20,500 to $21,600, reflecting the growing production costs.

Rising Labor and Manufacturing Costs

Higher living expenses ripple through the automotive sector, creating wage pressures. Workers, dealing with increased costs for essentials like food, housing, and transportation, demand higher wages. To retain skilled employees, manufacturers raise salaries, which adds to the price of vehicles.

Local production faces its own set of hurdles. Unreliable energy supplies push manufacturers to invest in backup systems, further driving up costs. Lee Naik, CEO of TransUnion Africa, pointed out the broader implications:

"Nominal loan amounts have grown but are not keeping pace with rising vehicle costs. This reflects both a decrease in disposable incomes and a diminished appetite among consumers for taking on expensive new credit responsibilities".

Even as inflation eased to 3.6% by October 2025, automakers continued to deal with challenges like export risks and fluctuations in the rand’s value. These factors add layers of uncertainty to future pricing strategies.

Currency Fluctuations and Import Costs

The instability of the rand has been a major driver of rising vehicle prices. When the rand weakens, it increases the cost of acquiring foreign currencies. For example, as of September 2024, the exchange rate hovered around 1 ZAR to 0.057 USD. These fluctuations compel both importers and manufacturers to adjust their strategies accordingly.

How Rand Depreciation Affects Import Prices

When the rand loses value, importers must spend more local currency to purchase vehicles and parts priced in foreign currencies. This creates challenges for manufacturers and dealers trying to plan ahead. The rand’s vulnerability to global events – like the 2008 financial crisis or the COVID-19 pandemic – has historically triggered sharp price hikes during periods of instability. As the cost of essential components for local assembly rises, manufacturers often pass those increases on to consumers to maintain their profit margins.

How Manufacturers Adjust Pricing

To adapt, automakers have expanded their offerings of budget-friendly options, particularly from Chinese brands. By mid-2025, these brands captured a notable 14.8% share of the market, reflecting a shift toward more affordable choices. Lee Naik, CEO of TransUnion Africa, highlighted this delicate balancing act:

"Improved affordability, aggressive incentives and growing demand for value brands, alongside modest support from two-pot withdrawals, helped sustain momentum through 2025. However… export risks and rand volatility adding uncertainty."

Manufacturers have also worked to keep new vehicle price increases aligned with or below the Consumer Price Index, aiming to maintain competitiveness with used cars. Additionally, they’ve introduced alternative ownership models, such as subscription services and leasing, to help consumers overcome challenges with traditional financing options.

Supply Chain Disruptions and Logistics Problems

Economic pressures are just one piece of the puzzle. Delivery delays are another, reducing supply and forcing dealers to hike prices. This supply crunch stems from two main issues: global component shortages and domestic shipping delays.

Global Component Shortages

Today’s vehicles are packed with technology, requiring up to 1,400 semiconductor chips each. Any disruption in chip production – whether it’s a plant fire at Renesas or extreme weather – can be devastating. In fact, the auto industry saw a staggering $110 billion in revenue losses in 2021 due to chip shortages.

Dan Hearsch, Managing Director at AlixPartners, summed it up perfectly:

"There are up to 1,400 chips in a typical vehicle today, and that number is only going to increase as the industry continues its march toward electric vehicles."

The impact of this shortage has been felt globally. In South Africa, the supply crunch sent new vehicle price inflation soaring from 4.0% in early 2022 to a peak of 6.7% by mid-2023. The ripple effect didn’t stop there. With fewer new cars available, the supply of quality used vehicles also dwindled, further tightening the market. By late 2025, as chip supplies stabilized, new vehicle inflation dropped to a record low of 1.5%. This shift highlights just how closely pricing depends on component availability.

Shipping Delays and Port Congestion

Even when components are available, shipping delays can throw a wrench into the supply chain. Global shipping issues are compounded by inefficiencies at local ports. For example, in May 2025, ships at Durban’s Point port faced up to two-day waits to dock. Once ashore, cargo often sat for four days due to rail delays, while cross-border rail shipments averaged a jaw-dropping 99-day delay. Frequent weather disruptions only made matters worse.

These logistical hiccups come with a hefty price tag. South African port charges for a 40-foot container are $821.60, compared to $80 in China and $364 in Brazil. With transportation costs accounting for 54% of logistics expenses – 14% higher than the global average – these costs inevitably trickle down to consumers.

Ann Wilson from the Motor Equipment Manufacturers Association pointed out the cascading effect of these challenges:

"We are seeing the greatest challenges to our supply chain that we have seen in decades, probably 20 or 30 years… backlogs at ports… even automakers who have enough computer chips on hand can still be hit in a crunch."

sbb-itb-09752ea

Local Manufacturing and Production Limits

Domestic production challenges add another layer to the rising car prices in South Africa. While the automotive sector contributes about 5% to 6% of the country’s GDP, it’s falling behind in meeting demand. In 2024, local plants produced 515,850 vehicles – a 3% decline compared to 2023. At the same time, imports dominate the market, accounting for 64% of all vehicles sold.

Production Capacity and Investment Challenges

South African factories face a steep hurdle: they struggle to source enough locally made components. Currently, local content in vehicle manufacturing is at 39%, far short of the 60% target outlined in Masterplan 2035. This heavy reliance on imported parts leaves manufacturers exposed to currency fluctuations and high logistics costs. The financial impact is significant – Trade Minister Parks Tau highlighted that increasing local content by just 5% could generate R30 billion in new procurement, far surpassing the R4.4 billion revenue from the U.S. export market.

On top of this, infrastructure issues like frequent power outages and inefficient ports have caused major setbacks. Over the past two years, these problems have led to 12 factory closures and the loss of more than 4,000 jobs. Without significant investment in modernizing plants – particularly for electric vehicle production – South Africa risks losing its 65% export market share, which would further drive up costs per unit. These production challenges are compounded by high labor costs, making vehicles more expensive.

Labor Costs in the Automotive Sector

Labor costs are another factor driving up car prices. Combined with expensive parts and energy, these costs lead to higher prices that manufacturers pass on to consumers. Unlike larger production hubs in the U.S., Europe, or Asia, South African plants operate at smaller production volumes, which increases the cost per vehicle. Jenny Tala, Southern Africa Director at Germany Trade & Invest, explains that weak economic growth, coupled with infrastructure problems, limits consumer spending power. High borrowing costs only make matters worse for potential buyers.

As a result, vehicles assembled locally often come with a higher price tag compared to similar models built in larger, more efficient facilities. Although government incentives under the Automotive Production and Development Programme help sustain jobs and stabilize the economy, they rarely lead to lower prices for consumers. Additionally, ongoing energy reliability issues and currency volatility continue to push up the cost of imported components, making it harder for local manufacturers to compete with cheaper imports.

How Rising Prices Affect Buyers

The rising cost of vehicles in South Africa is pushing consumers to rethink car ownership. While the amounts people are borrowing for car loans aren’t matching the soaring prices of vehicles, this growing financial strain is changing how buyers approach their choices and financing options.

Changes in Consumer Buying Patterns

To cope with affordability issues, South African buyers are shifting their preferences. One clear trend is the growing popularity of value brands, especially those from Chinese manufacturers. These brands offer a lower price point without compromising too much on functionality, making them an attractive alternative to traditional automakers.

Another noticeable shift is the rise of single-vehicle households. Families that previously owned multiple cars are now opting for one versatile vehicle – most often an SUV or crossover – to save money. This change is so widespread that SUVs and crossovers now account for over 47% of all financed vehicles. Meanwhile, the entry-level market is shrinking fast. Cars financed below R200,000 (around $11,000) made up just 20% of the market in 2023, down from 25% the year before.

Some buyers are choosing to skip ownership altogether, turning to ride-hailing services like Uber and Bolt or exploring vehicle subscription models as alternatives to buying a car outright. Additionally, the introduction of the "two-pot" retirement system has led to an unexpected trend: people are withdrawing funds early to cover vehicle deposits. This contributed to a 13,600-unit increase in used vehicle registrations above the baseline in October 2024.

Financing and Affordability Problems

The financial challenges for car buyers in South Africa don’t end with rising prices. Many who bought vehicles after 2021 now find themselves in negative equity, meaning their loan balances are higher than the trade-in value of their cars. This issue stems directly from the broader price hikes. Lee Naik, CEO of TransUnion Africa, explains:

"Those who purchased vehicles post-2021 have not yet reached a point where their loan balances can be offset by the trade value of their vehicles, and we also see consumers who opted for high balloon payments at the point of purchase holding on to their vehicles for longer".

This situation leaves many buyers stuck – they can’t trade in their current vehicles or upgrade to new ones. Some are even resorting to uncollateralized loans to bridge the gap between trade-in values and the cost of a new car. Meanwhile, borrowing costs have hit a 14-year high, and lenders are tightening their credit criteria to manage risks. As a result, the number of vehicles financed dropped by 10.6% in Q1 2024 compared to the same period the previous year.

Naik sums up the dilemma:

"Nominal loan amounts have grown but are not keeping pace with rising vehicle costs. This reflects both a decrease in disposable incomes and a diminished appetite among consumers for taking on expensive new credit responsibilities".

Ultimately, traditional car ownership is becoming less attainable for many South Africans, forcing a shift in how people view personal transportation and finance their mobility needs.

Conclusion

The rising cost of new cars in South Africa stems from a mix of factors, including currency fluctuations, supply chain delays, production constraints, and broader economic pressures. With new vehicle price inflation averaging 6.2% annually in 2023, these price increases are impacting not only individual buyers but also the broader economy.

For those feeling the pinch, the used car market offers a practical alternative. Accounting for 80% of all vehicle sales, it provides significant savings. For example, the value of two-year-old vehicles dropped by 1.9% in early 2024 compared to the previous year. Additionally, value-focused brands are becoming a popular choice for cost-conscious buyers.

"The ability to innovate, enhance financial inclusion, and adapt to the evolving mobility landscape remain crucial for achieving sustainable growth in the industry."

In this tough market, there are ways to navigate the financial strain. Refinancing options, dealer incentives, and vehicle subscription models can help. Many vehicle owners are also extending the life of their current cars – over 60% are now opting for replacement parts instead of buying new vehicles.

FAQs

Why do currency fluctuations affect car prices in South Africa?

Currency fluctuations have a major impact on car prices in South Africa. Since most new cars and parts are imported and priced in foreign currencies like the U.S. dollar or euro, the strength of the rand plays a big role. When the rand weakens against these currencies, importers need to spend more rand to cover the same costs. This pushes up expenses for manufacturers, which are then passed along to dealers and, ultimately, to consumers as higher car prices.

On the flip side, a stronger rand can ease price pressures for a while. However, because the market heavily depends on imports, even minor changes in exchange rates can cause noticeable price shifts. This unpredictability often leads manufacturers to either adjust prices or offer discounts to keep sales steady in a tough economic environment.

What are some alternatives to buying a new car as prices continue to rise?

With the rising costs of new cars, many people in South Africa are seeking more budget-friendly alternatives. One of the most popular choices is the used car market, which provides notable savings compared to purchasing a brand-new vehicle. While the prices of new cars have consistently climbed, the cost of pre-owned vehicles has stayed relatively steady. Financing options for used cars have also become a practical and economical solution for many buyers.

Another growing trend is the shift toward non-ownership models, such as leasing or car subscription services. These options allow individuals to use a vehicle for a set monthly fee, which often includes perks like maintenance and insurance. Without the long-term financial burden of ownership, these flexible arrangements are particularly attractive in a market where car prices and financing conditions can be unpredictable.

Why are new cars harder to find and more expensive in South Africa?

Supply chain disruptions continue to challenge manufacturers in South Africa, making it tough to keep up with the demand for new cars. Pandemic-related factory closures and a global semiconductor shortage have significantly slowed production, leaving dealerships with fewer vehicles on their lots.

With new car inventories running low, many dealerships have turned to the used-car market to fill the gap. This shift has pushed up prices for pre-owned vehicles while also reducing the availability of top-tier options. For buyers, this means longer waits, fewer model choices, and higher costs when looking for their next car.

Related Blog Posts

- Factors That Influence Used Car Prices in South Africa

- How Exchange Rates Affect Car Prices in South Africa

- Car Prices in South Africa in 2025: What’s Changed This Year?

- New vs Pre-Owned: South African Car Market Trends for 2025