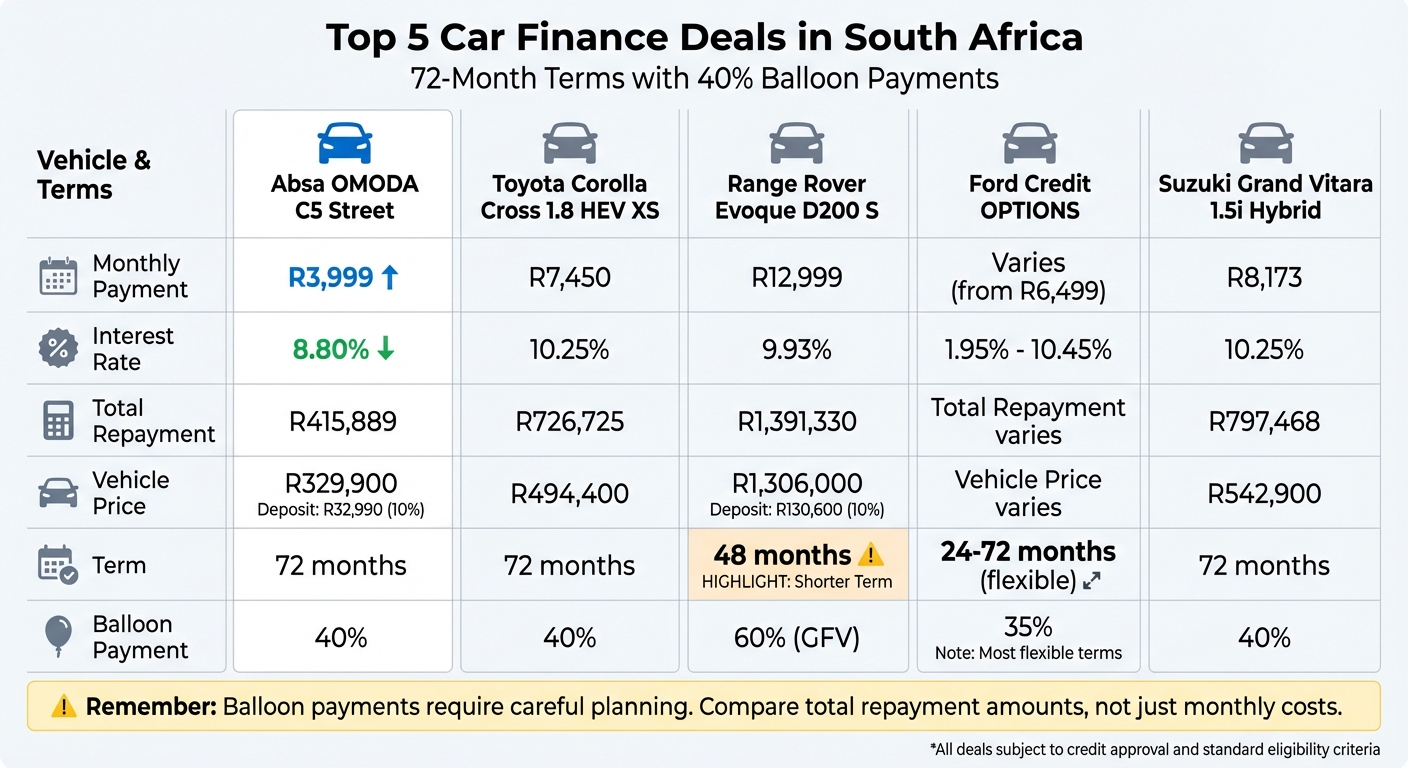

If you’re looking to finance a car in South Africa, understanding the total cost of credit is essential. This includes monthly payments, interest rates, balloon payments, and additional fees. Here’s a quick breakdown of five current car finance deals, all structured with a 72-month term and a 40% balloon payment to keep monthly installments lower:

- Absa OMODA C5 Street: R3,999/month, 8.80% interest, total repayment R415,889.

- Toyota Corolla Cross 1.8 HEV XS: R7,450/month, 10.25% interest, total repayment R726,725.

- Range Rover Evoque D200 S: R12,999/month (48 months), 9.93% interest, total repayment R1,391,330.

- Ford Credit OPTIONS: Flexible plans, interest rates from 1.95% to 10.45%, balloon payment 35%.

- Suzuki Grand Vitara 1.5i Hybrid: R8,173/month, 10.25% interest, total repayment R797,468.

Key Takeaway: While lower monthly payments may seem appealing, the balloon payment at the end of the term requires careful planning. Compare interest rates, total repayment amounts, and added perks like service plans to find the best deal for your budget.

Top 5 Car Finance Deals in South Africa: Monthly Payments & Total Costs Compared

Car Finance South Africa: Your Step-by-Step Guide + Pros & Cons

sbb-itb-09752ea

1. Absa OMODA C5 Street Finance Deal

The Absa finance deal for the OMODA C5 Street offers a straightforward way to own this vehicle, priced at R329,900. To get started, you’ll need a R32,990 deposit (10% down), with monthly installments of R3,999 spread over 72 months.

Interest Rates

This deal comes with an 8.80% interest rate. Over the loan term, the total repayment amounts to R415,889, which is R85,989 more than the car’s retail price. This figure includes interest, initiation fees, service fees, and interim interest. Keep in mind, the final interest rate is influenced by your credit profile and the current prime rate.

Repayment Terms

The financing is structured as a 72-month installment plan. After the R32,990 deposit, you’ll finance R298,118. The monthly payment of R3,999 covers the initiation fee but excludes the monthly service fee and interim interest for the first 30 days. Once all payments are completed, the car is fully yours.

Balloon Payment Options

This deal includes a 40% balloon payment, due at the end of the 72-month term. While this lowers the monthly installments, you’ll need to plan ahead for the lump sum payment at the end of the financing period.

Eligibility Criteria

To qualify, you must meet South Africa’s standard vehicle finance requirements. These include being at least 18 years old, earning a minimum of R7,500 per month, and holding a valid driver’s license. Additionally, you must be a South African citizen or permanent resident with a solid credit history and enough disposable income to prove affordability. Required documents include a valid ID, proof of address (dated within the last 3 months), three months of bank statements, and a recent payslip.

2. Absa Toyota Corolla Cross 1.8 HEV XS Finance Deal

Absa is offering a financing option for the Toyota Corolla Cross 1.8 HEV XS, following their OMODA C5 deal. This vehicle is priced at R494,400, with a monthly installment of R7,450 for 72 months. Over the loan term, the total repayment comes to R726,725, which includes an extra R232,325 above the purchase price. This additional amount covers interest, initiation fees, and service charges.

Interest Rates

The deal includes a fixed interest rate of 10.25%. However, your final rate may vary based on your credit profile and the current prime lending rate.

Repayment Terms

The financing period spans 72 months, with a loan amount of R495,608, which factors in an initiation fee of R1,207.50. The monthly payment of R7,450 includes the initiation fee but does not cover the monthly service fee of approximately R69.00. Under this installment sale agreement, full ownership of the vehicle transfers to you after completing all payments.

Balloon Payment Options

This deal includes a 40% balloon payment, translating to around R197,760, which is due at the end of the term. At that point, you’ll need to either pay the balloon amount in full, refinance it, or settle it through a trade-in. Keep in mind that interest is charged on the total financed amount, including the balloon portion.

Eligibility Criteria

To qualify, you’ll need to meet the standard requirements for vehicle financing in South Africa.

3. Range Rover Evoque D200 S Guaranteed Future Value Offer

Land Rover Finance, in partnership with WesBank, presents a Guaranteed Future Value (GFV) deal for the Range Rover Evoque D200 S. The vehicle comes with a price tag of R1,306,000 (including extras). With a 10% deposit of R130,600, monthly payments start at R12,999 over a 48-month term, with interest rates beginning at 9.93%. The total cost of finance, including fees, amounts to R1,391,330. This includes an initiation fee of R1,207.50 and a monthly service fee of R69.

Interest Rates

The starting interest rate is 9.93%, tied to the prime lending rate. This means the rate may fluctuate along with changes in the prime rate.

Repayment Terms

The GFV offer spans a 48-month term, with a mileage cap of 80,000 km. Your monthly payments include license, registration, and CO₂ emissions costs but exclude a one-time delivery fee. A standout feature of the deal is the "Luxury to Pause" option, allowing you to skip one monthly payment each year during the contract period. This offer is available until January 31, 2026.

Balloon Payment Options

At the end of the term, the GFV structure sets a pre-agreed value of R778,116, which defers 60% of the vehicle’s cost. When the contract ends, you have three choices:

- Trade in the vehicle for a newer model.

- Pay the GFV amount to keep the car.

- Return the vehicle to the dealership at the guaranteed price.

This setup ensures protection against market depreciation by locking in the car’s value. All terms are subject to standard qualifying criteria.

Eligibility Criteria

To qualify, applicants must meet the following requirements:

- Be at least 18 years old.

- Hold South African citizenship or permanent residency with a valid driver’s license.

- Earn a minimum monthly income of R7,500.

- Provide the necessary documentation.

Additionally, the vehicle must stay within the 80,000 km mileage limit to maintain the Guaranteed Future Value agreement.

4. Ford Credit OPTIONS Balloon Instalment Sale

The Ford Credit Balloon Instalment Sale offers a flexible way to finance both new and used vehicles. With this plan, 35% of the loan amount is deferred to the end of the term, which can range from 24 to 72 months. This option is available for both individuals and businesses, with financing offers valid from January 1, 2026, through March 31, 2026. Here’s a closer look at the details.

Interest Rates

Ford Credit provides both fixed and variable interest rate options. Variable rates adjust based on the prime lending rate, while fixed rates remain steady throughout the loan term, though they typically start slightly higher. Promotional rates range from 1.95% to roughly 10.45%, with most hovering around 10.25%.

Repayment Terms

You can choose repayment terms of 24, 36, 48, 60, or 72 months. If you decide to settle the loan early, an early settlement fee may apply. Ford also offers a Deferred Payment Plan, allowing you to delay your first payment by up to 90 days. However, the interest from the deferred period will be recalculated and spread across the remaining term. For instance, 0% deposit financing starts at R6,499 for the Territory Ambiente 1.8L 7AT, R7,399 for the Ranger XL 2.0L, and R11,099 for the Ranger Wildtrak 2.0L.

Balloon Payment Options

At the end of the loan term, you’ll need to address the balloon payment, which equals 35% of the loan amount. You have three options: pay the amount in cash, refinance it (subject to credit approval), or sell the vehicle to settle the balance. Keep in mind, if the vehicle’s market value is lower than the balloon amount, you may face a shortfall. It’s important to plan for this final payment.

Eligibility Criteria

To qualify, applicants must meet South Africa’s standard vehicle finance requirements. This financing option is open to both individuals (natural persons) and businesses (juristic persons). Applicants will need to provide a valid ID, proof of residence (dated within three months), three months of bank statements, and recent proof of income.

5. Suzuki Grand Vitara 1.5i GLX 6AT Hybrid ALLGRIP Absa Finance Deal

The Suzuki Grand Vitara 1.5i GLX 6AT Hybrid ALLGRIP comes with a price tag of R542,900. Through Absa financing, you can spread the cost over 72 months with a 40% balloon payment. Monthly installments come to R8,173, bringing the total repayment to R797,468.

Interest Rates

Absa offers this deal at a linked interest rate of 10.25%. Since it’s tied to the prime lending rate, your monthly payments could change if the repo rate fluctuates. The actual interest rate you receive depends on your credit profile, meaning those with a strong credit history may qualify for better terms. This linked rate provides a predictable repayment structure, barring any major changes in the economic climate.

Repayment Terms

The financing term spans 72 months, which is the longest repayment period Absa typically offers for installment sale agreements. While this extended term keeps the monthly payment at R8,173, it does result in higher total interest over time compared to shorter repayment periods. The monthly amount also includes an initiation fee.

Balloon Payment Options

A standout feature of this deal is the 40% balloon payment, which helps lower your monthly installments. However, at the end of the 72-month term, you’ll need to settle this lump sum, which accounts for 40% of the vehicle’s financed value. You can manage this final payment through cash, refinancing, or trading in the vehicle, so it’s important to plan ahead.

Eligibility Criteria

To qualify for this financing deal, applicants must meet Absa’s standard requirements. South African residents need to provide a valid SA ID book or card, proof of address (dated within three months), and their most recent salary slip. Foreign residents must submit a valid work permit, passport, international driver’s license, a letter of appointment or payslip, and three months of bank statements if they are not Absa clients. Additionally, comprehensive insurance is mandatory for all applicants to secure the financing.

Finance Deal Comparison

When you compare these finance deals side by side, the differences become quite clear. Monthly payments range from R6,999 to R8,173, while interest rates span from 8.80% to 10.25%. The total repayment amounts vary depending on the vehicle’s base price and the financing terms.

All five deals share the same structure: a 72-month term paired with a 40% balloon payment. This setup helps keep the monthly payments lower, but it’s important to plan ahead for the larger lump-sum payment at the end.

| Vehicle | Monthly Payment | Interest Rate | Loan Term | Balloon Payment | Total Repayment |

|---|---|---|---|---|---|

| Absa OMODA C5 Street | R6,999 | 10.25% | 72 months | 40% | R683,928 |

| Absa Toyota Corolla Cross 1.8 HEV XS | R7,999 | 8.80% | 72 months | 40% | R759,928 |

| Range Rover Evoque D200 S | R8,099 | 9.50% | 72 months | 40% | R791,048 |

| Ford Credit OPTIONS | R7,499 | 9.25% | 72 months | 40% | R731,904 |

| Suzuki Grand Vitara 1.5i GLX 6AT Hybrid ALLGRIP | R8,173 | 10.25% | 72 months | 40% | R797,468 |

Note: Standard eligibility criteria apply for all these offers.

This breakdown highlights both shared features and standout differences. For instance, the Toyota Corolla Cross offers the lowest interest rate at 8.80%, while the OMODA C5 Street has the most affordable monthly payment at R6,999. Ultimately, your decision should align with your financial priorities – whether it’s minimizing monthly costs or reducing total interest paid over time.

Conclusion

To wrap up the key takeaways from our comparisons: finance deals can differ widely in terms of monthly costs and interest rates. While lower monthly payments might seem appealing, it’s crucial to look beyond them and focus on the total repayment amount. This includes the 40% balloon payment due at the end of the term, which requires careful planning.

Remember, the total cost of credit factors in more than just the monthly installments – it includes interest, initiation fees, and service charges that add up over time. Paying attention to this full picture can help you avoid surprises down the road.

If you’re unable to manage the balloon payment, consider options like refinancing or selling the vehicle to settle the balance. It’s also worth reviewing your credit profile and exploring the possibility of a higher deposit. A larger deposit can lower both your monthly payments and the overall interest you’ll pay. Keep in mind that your credit score plays a role in determining your interest rate, and meeting the minimum income requirement – usually between R6,000 and R8,000 – is key for approval.

Ultimately, choose a plan that fits your budget and aligns with your long-term financial goals.

FAQs

What is a balloon payment, and how does it impact your car financing?

A balloon payment is a sizable, one-time payment due at the conclusion of a car financing agreement. This amount usually accounts for a large portion of the vehicle’s original price and is designed to reduce your monthly payments during the loan term. While it can ease monthly budgeting, it requires careful planning for that final payment.

When the time comes to address the balloon payment, you have a few options: pay it off in full, refinance the remaining amount, or trade in the car. While this setup can make financing more manageable in the short term, it’s crucial to ensure you’ll be prepared for the lump sum at the end. Take a close look at your financial situation and long-term goals before deciding if a balloon payment is the right choice for you.

How do interest rates affect the total cost of a car loan?

Interest rates have a big impact on how much a car loan ultimately costs you. When interest rates are high, you’ll end up paying more over the life of the loan. This not only raises your monthly payments but also increases the total amount you repay. On the flip side, lower interest rates can make your loan much easier on your wallet by reducing the interest you’re charged.

Take this example: a car loan with a 7.75% interest rate will cost you far less in the long term compared to one with a higher rate. Interest rates are shaped by factors like the state of the economy and monetary policies. That’s why locking in a lower rate can lead to significant savings. It’s always a smart move to shop around and compare rates and loan terms to ensure you’re getting the best deal for your situation.

What factors should I consider when selecting a car finance deal?

When comparing car financing options, the first thing to examine is the interest rate, as it has a big impact on the overall cost of your loan. A lower rate means you’ll pay less in the long run. Next, think about the loan term. Shorter terms come with higher monthly payments but reduce the total interest you’ll pay. On the other hand, longer terms might feel easier on your wallet each month but will cost more in interest over time.

It’s also important to understand the type of financing you’re considering. Are you looking at a traditional installment plan where you own the car outright after finishing payments, or is it a lease that gives you options at the end of the term? Don’t overlook extra costs like initiation fees, balloon payments, or whether perks like insurance and warranties are part of the deal. Most importantly, make sure the financing fits your budget and repayment ability to avoid unnecessary financial stress.

Related Blog Posts

- How to Get the Best Finance Deal When Buying a Car in SA

- Top 5 Cars to Buy in South Africa for Less Than R 150 000

- How to Finance a Car in South Africa: What You Should Know

- Ultimate Guide To Used Car Negotiations