Buying repossessed cars in South Africa can save you money, with prices often 10–20% below market value. These cars are sold by banks or auction houses after borrowers default on loans. However, they come "voetstoots" (as-is), meaning buyers are responsible for any defects or repairs. Here’s what you need to know:

- Where to Find Them: Major banks like Absa, Nedbank (MFC), FNB, and Standard Bank sell repossessed cars through auctions managed by partners like Burchmores, Aucor, and Park Village Auctions.

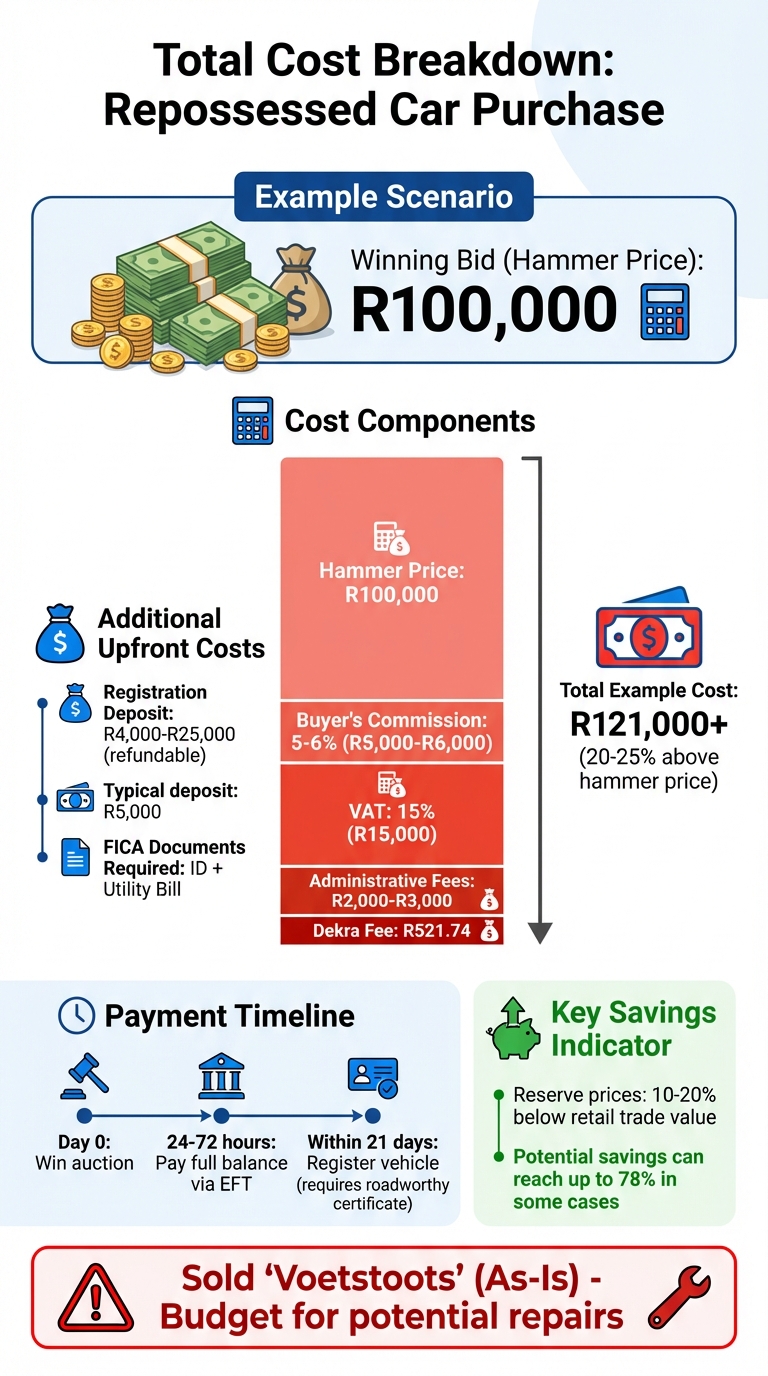

- Costs to Expect: Beyond the bid price, you’ll pay a 5–6% commission, 15% VAT, and administrative fees of around R2,000–R3,000. A refundable deposit (R4,000–R25,000) is required to register for auctions.

- Preparation: Research the car’s market value, set a strict budget, and secure financing in advance. Bring FICA documents (ID and utility bill) to register.

- Inspection: Test drives aren’t allowed. Inspect cars during viewing days, check the VIN for service history, and look for any remaining warranties.

- Bidding Tips: Auctions move fast. Stick to your budget, factor in all fees, and plan for potential repair costs.

The TRUTH About Bank Repossessed Car Auctions In South Africa

sbb-itb-09752ea

Where to Find Repossessed Cars

In South Africa, repossessed vehicles are primarily sourced through the country’s major banks. Institutions like Absa, Nedbank (via MFC), FNB, and Standard Bank regularly reclaim cars from borrowers who have defaulted on their loans. These banks aim to recover outstanding balances quickly, so they often sell these vehicles at prices below retail value through auctions.

Rather than managing the sales themselves, most banks partner with auction houses such as Burchmores, Aucor, and Park Village Auctions. These companies handle the logistics, from vehicle storage to organizing the bidding process. For instance, Absa collaborates with Park Village Auctions and Burchmores, hosting auctions at its Boksburg and Midrand trade centers, typically on Thursdays and Saturdays.

Banks and Financial Institutions

Banks offer a direct way to access repossessed cars. For example, Nedbank’s MFC Auction House has a dedicated platform (mfcauctions.co.za) where you can browse available vehicles and register to participate in auctions. Similarly, Standard Bank provides a list of approved auction partners on its website and cautions buyers against dealing with unverified sellers.

To register for an auction, you’ll need to provide FICA documentation, which includes a certified copy of your ID and a utility bill no older than three months. Most banks also allow potential buyers to inspect vehicles during designated viewing days, typically held one or two days before the auction. During these inspections, you’ll find detailed information sheets outlining known faults and mileage. To participate, a refundable registration deposit – usually around R5,000 – is required.

If bank-specific auctions don’t meet your needs, auction houses offer additional options to explore.

Auction Houses

Auction houses serve as a bridge between banks and buyers, often offering a wider range of vehicles compared to what individual banks provide. Platforms like Repossessed.co.za aggregate listings from multiple sources, enabling users to browse inventory and place bids online.

Keep in mind, the costs go beyond the auction’s hammer price. Buyers should be prepared to pay:

- A commission of 5% to 6%

- 15% VAT

- Administrative fees of approximately R2,250

- A Dekra fee of around R521.74.

If you’re new to auctions, it’s a good idea to attend a few as an observer first. This will help you get comfortable with the fast-paced and competitive nature of the bidding process.

Preparing Your Finances

Complete Cost Breakdown for Buying Repossessed Cars in South Africa

Before stepping into an auction, it’s crucial to know your absolute spending limit. The hammer price is just the starting point – VAT, commission, and admin fees will add an extra 20% to 25% to your final cost. For instance, if you win a bid at R100,000, your total could climb to around R121,000 after factoring in a 6% buyer’s commission and 15% VAT. Additionally, plan for at least R2,000 in administrative paperwork fees, plus licensing and registration costs.

Repossessed vehicles often have reserve prices set 10% to 20% below retail trade value, but popular models might be closer to their current "book" value. To avoid overpaying, research the car’s actual market value. Use online tools to compare the retail and trade prices for the specific make, model, and year you’re targeting. As AutoTrader explains, "The reserve price is based only on market values and does not reflect the amount owing on the repossessed vehicle". Set a firm maximum bid that keeps your total cost – including all added fees – below the retail price. This preparation ensures you stay within budget and avoid surprises.

Setting Your Budget and Checking Market Prices

Determine how much you can afford monthly to establish a firm maximum bid that includes both the hammer price and additional fees. Many banks provide online installment calculators to help you estimate monthly payments based on loan amounts. Keep in mind, repossessed cars are sold "voetstoots" (as-is), meaning you’re responsible for any repairs after purchase. Since financially distressed previous owners may have skipped maintenance, set aside funds for urgent repairs.

To minimize repair costs, focus on vehicles with manufacturer warranties or active maintenance plans. Use the VIN number from the license disc to check the car’s service history with the original dealership. This can reveal any signs of neglect or mechanical issues. Standard Bank advises, "It’s best to have a budget in mind and stick to it", especially since the high-energy auction environment can tempt bidders to overspend.

Getting Pre-Approved Financing and Understanding Costs

Once you’ve set a clear budget, securing financing ahead of time is a smart move. Pre-approval through your bank or an auction finance provider simplifies the process and ensures you’re ready to bid confidently. Most auction houses require proof of funds – such as a pre-approval letter or a certified bank statement – before allowing you to register. A credit score of 621 or higher can help you secure better interest rates and more favorable financing options in South Africa.

You’ll also need to pay a refundable registration deposit to confirm your intent and gain bidding eligibility. However, if you win the auction but fail to pay within the required timeframe – usually two days – you risk losing this deposit. To avoid last-minute stress, gather all necessary FICA documents in advance so you can focus on the auction itself without scrambling for paperwork.

Inspecting the Vehicle

Once you’ve secured financing, the next crucial step is ensuring the vehicle’s condition meets your expectations. Auction houses typically offer viewing days one or two days before the sale, giving you a chance to examine the cars up close. Since test drives aren’t allowed – the bank maintains ownership until the auction concludes – a thorough inspection is your best safeguard against unexpected repair bills. This step is essential to align with your carefully planned budget.

Checking VIN History, Service Records, and Warranties

Start by locating the VIN (Vehicle Identification Number). You’ll usually find it on the license disc, the dashboard near the windshield on the driver’s side, or the door jamb. Use this number to contact the original dealership and request the car’s service history. This will help you determine if the previous owner kept up with regular maintenance. Skipping services, especially during financial hardship, can lead to significant mechanical issues down the line.

Verify the current mileage against historical records to catch potential odometer rollbacks. Additionally, check with the local police to ensure the car hasn’t been reported stolen [20,6]. At the auction house, look for the information sheet on the windshield. It lists known faults and details about any remaining warranties. In South Africa, warranties generally cover three years or 100,000 km, whichever comes first.

As Stuart Johnston, Journalist, AutoTrader cautions, "Any evidence of unauthorised work having been carried out on the car could very likely invalidate the warranty and maintenance plan".

Confirming the warranty is still active can save you from hefty repair expenses later. After verifying the car’s history and warranty, move on to a detailed physical and mechanical inspection.

Conducting Visual and Mechanical Inspections

Bring along a trusted mechanic or a knowledgeable friend to help identify potential issues. Start with the exterior – inspect the door gaps and body panel alignment. Uneven gaps can signal previous accident damage. Use a magnet to check the body panels; if it doesn’t stick, body filler might be hiding repairs. Keep an eye out for mismatched paint or "over-spray" in the engine bay, which could indicate undocumented collision repairs.

Inside the vehicle, test every button and electronic feature. Odd smells, like mold or cigarette smoke, may hint at leaks or poor upkeep. Ask auction staff to start the engine so you can listen for unusual ticking or knocking sounds. Inspect fluid levels and check under the car for leaks. Finally, examine the tires for uneven wear, as this could point to alignment or suspension problems.

As Stuart Johnston, Journalist, AutoTrader emphasizes, "The auction houses provide no level of guarantee on any vehicle sold at auction".

This makes a hands-on inspection your most reliable way to avoid buying a car that could drain your wallet with hidden repairs.

Bidding and Completing Your Purchase

Once you’ve inspected the vehicle, it’s time to dive into the auction process. Knowing how auctions work and understanding the legal responsibilities tied to your purchase can save you from expensive mistakes and help you complete the transaction without a hitch.

How Auctions Work

Start by registering with the auction house. You’ll need valid FICA documents and a refundable deposit – usually around R5,000 – to secure your bidder number. After registration, familiarize yourself with how the bidding process unfolds.

Bidding begins at a reserve price, typically set 10% to 20% below the vehicle’s retail trade value. When you’re ready to bid, just raise your hand or paddle. Auctions move quickly, so it’s critical to set a firm spending limit beforehand. Don’t forget to factor in additional costs like 15% VAT, a 5–6% auctioneer commission, and administrative fees starting at R2,000. Once the auctioneer’s hammer falls, the sale is legally binding.

According to AutoTrader, "If you make a successful bid on a car, but then fail to pay for a car… you will lose your deposit."

If you win, you’ll need to pay the balance via EFT within 24 to 72 hours. You’ll also need to register the car in your name within 21 days, which requires a roadworthy clearance certificate. Missing the payment deadline means forfeiting your deposit, so plan accordingly. If you’re new to auctions, consider attending a few as an observer before jumping in. Once your bid is confirmed, proceed with legal checks to finalize the deal.

Legal Checks and Understanding Voetstoots Sales

After winning a bid, it’s essential to verify the vehicle’s legal status. Keep in mind that repossessed cars are sold "voetstoots", which means they are sold as-is. Any defects or repairs become your responsibility the moment the hammer falls.

MFC Auction House explains, "All these vehicles are sold ‘voetstoots’ and without an obligation to repair, so you must be well-informed to avoid any unforeseen repair bills."

This means neither the auction house nor the bank will cover mechanical or cosmetic issues discovered after the sale. To avoid surprises, verify the vehicle’s VIN and cross-check your findings with your earlier inspection. You can also contact the original dealership to check service records and see if any warranties are still valid.

Pay close attention to the information sheet displayed on the car’s windshield. This document typically lists known faults and may include a Dekra condition report. Since test drives aren’t allowed, this paperwork, combined with your physical inspection, is your best defense against buying a car with hidden problems.

Finally, calculate your total cost upfront. This includes your bid amount, VAT, auctioneer commission, administrative fees, and any expected repair costs. Knowing these numbers ahead of time helps you stick to your budget and avoid buyer’s remorse.

Common Mistakes to Avoid

When diving into repossessed car auctions, even with careful planning and inspections, there are common mistakes that can lead to unexpected expenses. Avoiding these pitfalls requires a mix of vigilance, expertise, and preparation.

Identifying Hidden Damage and High Mileage

Cars sold at auction often come from financially distressed owners, which can mean neglected upkeep. As Used Cars For Africa points out, "Very often the fact that the previous driver was struggling financially means that maintenance, regular services and in addition, repairs may well have been neglected". Without the chance to test drive the vehicle, you’re left relying on visual inspections and available documentation.

The information sheet on the car’s windscreen will detail known faults and any remaining warranty coverage. However, it won’t tell the whole story. To avoid surprises, bring a trusted mechanic on viewing days. They can spot things you might miss, like subtle engine issues, transmission problems, or structural damage that could cost you later.

Beyond identifying hidden damage, it’s essential to prepare for potential repair costs.

Planning for Repair Costs

Repossessed cars are sold voetstoots – meaning "as is." This makes it crucial to budget for repairs right from the start. Based on what your mechanic observes during the inspection, set aside a realistic repair fund to handle any surprises.

If possible, target vehicles with remaining manufacturer warranties, which might cover some undetected issues. Another smart move? Consider investing R571.74 in a Dekra inspection report at MFC auctions. This third-party evaluation provides a professional assessment of the car’s condition, potentially saving you thousands in unforeseen repair costs.

Conclusion

Buying a repossessed car in South Africa offers the potential for big savings, with reserve prices often 10% to 20% lower than retail value. In some cases, discounts can even climb as high as 78%. But snagging a great deal requires careful planning and a strategic approach.

Practical auction strategies are key to success. Start by attending a few auctions just to observe. This helps you get a feel for how bids escalate and how the process works before you commit to participating.

Since repossessed cars are sold voetstoots – which means “as is” – a detailed inspection is a must. Bring along a trusted mechanic during viewing days to assess the car’s condition. Check the VIN history for any red flags, and prioritize vehicles that still have manufacturer warranties. These steps can help safeguard you from unexpected repairs or defects.

As the MFC Auction Guide wisely advises, "If you are unsure whether you should bid on a vehicle, always err on the side of caution by not taking part in the bid".

This advice underscores the importance of exercising restraint during bidding. A cautious approach can help you avoid costly surprises after the sale.

Once you’ve thoroughly inspected the vehicle, make sure all legal and financial matters are squared away. Stick to reputable banks and auction houses to ensure the paperwork is legitimate. And don’t forget – payment is typically required within 24 to 72 hours, so having pre-approved financing is crucial.

With the right preparation, you can drive away with a quality vehicle at a fraction of the cost, all while avoiding unnecessary headaches.

FAQs

What should I watch out for when buying a repossessed car in South Africa?

When buying a repossessed car in South Africa, there are a few risks you need to watch out for. First, these cars are sold as is, with no warranties or guarantees. This means you’ll need to inspect the vehicle carefully for any hidden mechanical or structural problems – especially since test drives are often not allowed at auctions. If issues go unnoticed, you could end up with costly repairs down the line.

Another challenge is the risk of overpaying, particularly if you’re not familiar with the car’s market value or how auctions work. On top of the bid price, extra expenses like auction fees, VAT, and transfer charges can pile up fast. To avoid unpleasant surprises, take time to research the car’s history, confirm its condition, and set a firm budget before you start bidding. A little preparation can go a long way in helping you make a smarter purchase.

How can I check if a repossessed car is legal and free of issues before buying?

Before buying a repossessed car, it’s crucial to check its legal status and history to steer clear of potential headaches down the road. Start by thoroughly examining the vehicle’s official paperwork to verify ownership and confirm there are no liens, unpaid debts, or legal complications attached to it. To dig deeper, consider using a reliable vehicle history service to uncover any red flags, such as reports of the car being stolen or involved in major accidents.

Whenever possible, inspect the car in person at the auction site or seller’s location. Keep in mind that repossessed vehicles are often sold "as is", so check for visible damage or mechanical problems that could lead to expensive repairs. Many reputable sellers or auction platforms will provide details about known issues or encumbrances upfront – don’t hesitate to ask for this information. Taking these precautions can help you make a well-informed decision and reduce the risks associated with purchasing a repossessed car.

What extra costs should I plan for when buying a repossessed car?

When buying a repossessed car, it’s crucial to factor in extra costs beyond the sticker price. These might include registration and title fees, sales tax, and a buyer’s commission if you’re purchasing through an auction. On top of that, you’ll likely need to budget for repairs or maintenance to bring the car up to standard. Depending on the seller, you might also face administrative or legal fees.

To steer clear of unexpected expenses, make sure to thoroughly inspect the car and plan for any necessary fixes or upgrades. Setting aside funds for these additional costs can make the entire process much smoother and less stressful.

Related Blog Posts

- Where to buy safe used cars in South Africa

- Avoid scams when buying used cars in SA

- The Pros and Cons of Buying a Repossessed Car in SA

- Repossessed Cars in South Africa: Where to Buy and What to Check