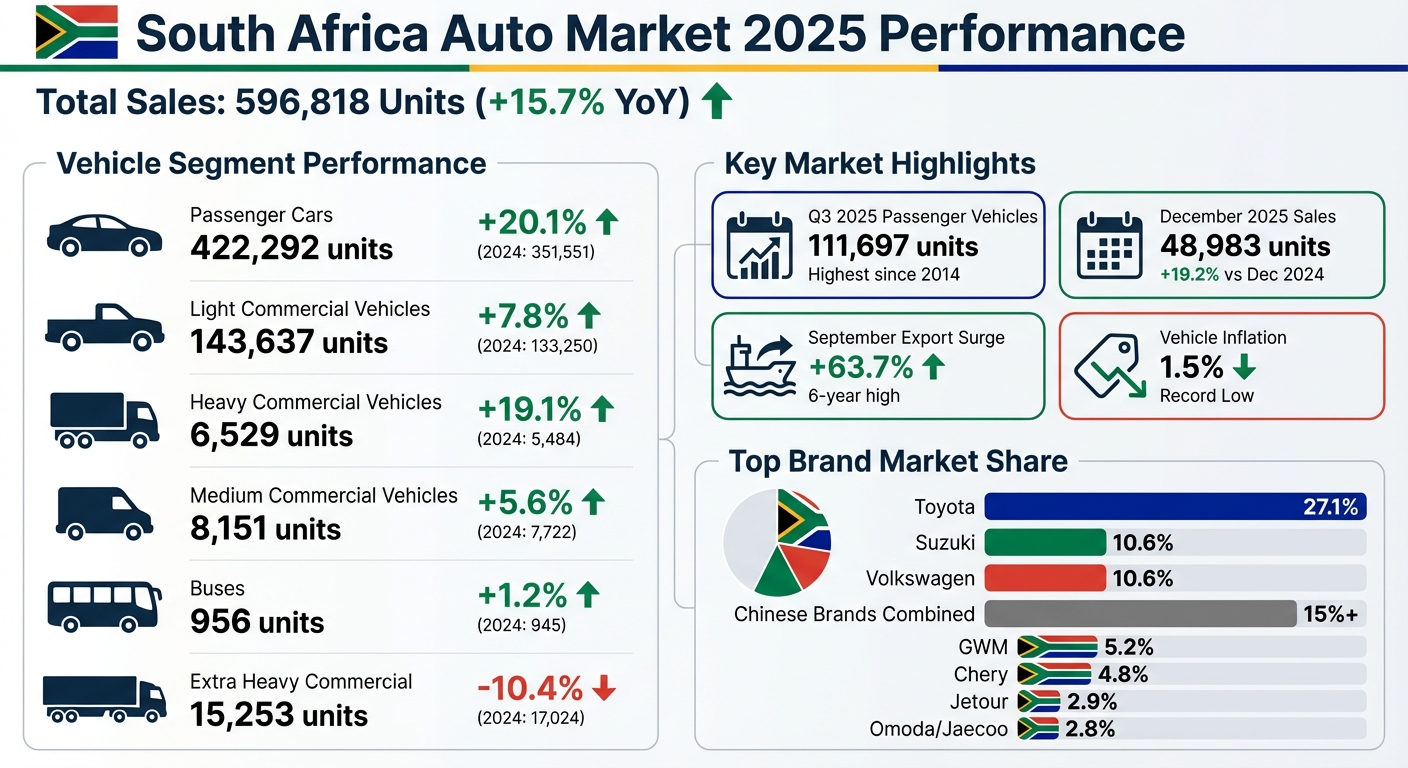

South Africa’s auto market hit an 11-year high in 2025, with new vehicle sales reaching 596,818 units – a 15.7% increase from 2024. This growth was fueled by lower interest rates, a stronger rand, record-low vehicle inflation (1.5%), and increased liquidity from the country’s "two-pot" retirement system. Key trends included:

- Chinese automakers gained over 15% market share, growing nearly nine times faster than the overall market.

- Passenger vehicles led sales, up 20.1% year-over-year, while exports surged by 63.7% in September 2025.

- Younger buyers dominated, with 21% of Gen Z and 19% of Millennials planning vehicle purchases, compared to just 8% of Baby Boomers.

- Hybrid and plug-in hybrid vehicles gained traction, with plug-in hybrids growing by 241% in 2025 due to affordability and practicality.

While economic stability helped boost consumer confidence, affordability challenges remain, with a 1.56:1 used-to-new financing ratio showing more buyers leaning toward pre-owned vehicles. Electrification is gaining momentum, but high upfront costs and limited charging infrastructure are barriers for many.

As 2026 approaches, easing interest rates and continued demand for value-focused vehicles are expected to shape the market, though affordability and infrastructure gaps could temper growth.

🇿🇦 South Africa’s Car Market Will Never Be The Same – Episode #143

2025 Sales Performance Data

South Africa Auto Market 2025: Sales Growth by Vehicle Segment

The 2025 sales figures highlight a strong rebound in South Africa’s vehicle market, building on the trends discussed earlier. Here’s a detailed breakdown of the year’s performance across various vehicle segments.

New Vehicle Sales and Growth Numbers

South Africa’s new vehicle market hit 596,818 units in 2025, marking a 15.7% increase from 2024. This represents the highest annual sales volume in over a decade and surpasses pre-pandemic levels from 2019.

Passenger vehicles led the pack, climbing to 422,292 units – a 20.1% jump. Light Commercial Vehicles (LCVs) followed with 143,637 units sold, up 7.8%. Medium Commercial Vehicles (MCVs) and Heavy Commercial Vehicles (HCVs) also saw increases of 5.6% and 19.1%, respectively. However, Extra Heavy Commercial Vehicles dropped to 15,253 units, reflecting a 10.4% decline. The table below provides a snapshot of these year-over-year changes:

| Vehicle Segment | 2025 Total Units | 2024 Total Units | Year-on-Year Change |

|---|---|---|---|

| Passenger Cars | 422,292 | 351,551 | +20.1% |

| Light Commercial Vehicles (LCV) | 143,637 | 133,250 | +7.8% |

| Medium Commercial Vehicles (MCV) | 8,151 | 7,722 | +5.6% |

| Heavy Commercial Vehicles (HCV) | 6,529 | 5,484 | +19.1% |

| Extra Heavy Commercial Vehicles | 15,253 | 17,024 | -10.4% |

| Buses | 956 | 945 | +1.2% |

| Total Market | 596,818 | 515,976 | +15.7% |

Quarterly and Seasonal Sales Patterns

Beyond the annual growth, seasonal trends played a key role in shaping the market’s momentum. The third quarter of 2025 stood out as the strongest, with 111,697 passenger vehicles sold – a 23.4% year-over-year increase and the highest quarterly total since 2014. Dealer promotions and corporate fleet renewals significantly contributed to this surge.

December 2025 also capped the year on a high note, with 48,983 units sold, reflecting a 19.2% increase compared to December 2024. Meanwhile, passenger vehicle exports experienced a major recovery, with September exports soaring by 63.7%, hitting a six-year high. These figures underscore the market’s strong performance across both domestic and export segments.

Market Share Changes Among Brands

The sales landscape in 2025 showcased shifting market shares, reflecting changes in brand dynamics and a recovering market. While traditional leaders held their ground, emerging players made notable strides. Toyota dominated the combined Passenger and Light Commercial Vehicle segment, securing a 27.1% market share by December 2025. Meanwhile, Suzuki and Volkswagen each captured 10.6% of the market.

Leading Brands in 2025

Mahindra and Kia stood out as the fastest-growing brands during the first half of 2025. Mahindra posted an impressive 58.6% growth, while Kia followed closely with a 41.5% increase in sales. Suzuki also strengthened its position as Toyota’s closest competitor, achieving 22.5% growth early in the year and consistently maintaining a double-digit market share throughout 2025. By October 2025, Suzuki Auto South Africa celebrated its fourth consecutive month of sales exceeding 6,000 units, with a total of 6,890 vehicles sold. Key contributors to this success were the fourth-generation Swift hatchback (2,377 units) and the Fronx crossover (1,369 units).

While established brands like Suzuki continued to thrive, emerging Chinese and Indian manufacturers aggressively expanded their presence.

Chinese and Indian Manufacturers’ Growing Presence

Chinese brands experienced remarkable growth, collectively surpassing the sector’s overall pace and claiming over 15% of the market by the third quarter of 2025. Among these, GWM captured 5.2%, Chery secured 4.8%, and newcomers Jetour and Omoda/Jaecoo achieved 2.9% and 2.8%, respectively, by December 2025. Year-on-year growth for Chinese brands was striking, with an 89% increase in Q2 2025 and 88% in Q3 2025. Individual brands also saw substantial gains, including JAC (67%), GWM (54%), and Chery (35%).

This surge by Chinese and Indian manufacturers highlights their growing influence in reshaping the competitive landscape.

Electric Vehicles and Electrification Trends

As market dynamics shift, electrification is steadily influencing consumer decisions and reshaping the automotive landscape.

In South Africa, while electric vehicles (EVs) make up less than 1% of total car sales, the market saw a sharp 23.4% growth through April 2025 – far outpacing the overall market growth of 7.9%. This surge is fueled by seven years of rising fuel costs and increased local manufacturing efforts, driving a demand for more efficient vehicles.

EV Sales Growth and Leading Brands

Premium German automakers are leading the charge in EV sales. BMW experienced a 32.4% increase, securing over half of the EV market. Meanwhile, Mercedes-Benz and Audi posted growth rates of 15.6% and 10.7%, respectively. MINI also made waves with a remarkable 77.8% jump in sales of its electrified models, highlighting strong demand for smaller EVs. Among higher-income households earning over $10,850 per month (R200,000+), 75% are opting for plug-in hybrids, attracted by their lower upfront costs.

The Growing Appeal of Hybrids and Plug-In Hybrids

While fully electric vehicles are gaining traction among premium buyers, hybrids remain a practical choice for many, especially given challenges like charging infrastructure and load shedding.

Hybrids have emerged as a go-to option for consumers navigating these hurdles. In 2024, Toyota doubled its hybrid sales to 13,604 units, with the Corolla Cross Hybrid accounting for 74% of those sales.

The plug-in hybrid market saw explosive growth, surging by 241% in 2025. This was driven by a wider range of models from both traditional and premium brands. Hailey Philander, Manager of Group Automotive Communications at BMW Group South Africa, noted:

"Overall demand for battery-electric vehicles (BEV or fully-electric vehicles) is in decline, while the broader PHEV segment has grown by 241%, driven by broader choice across traditional and premium brands."

Chinese automakers are also benefiting from this trend. For instance, Chery’s Tiggo 9 PHEV recorded a 36.36% month-on-month sales increase between August and September 2025. Consumer preferences reflect this shift, with 39% leaning toward hybrids and 24% considering plug-in hybrids.

Government Support and Incentives

The South African government is stepping in to accelerate the adoption of EVs and hybrids. A $54.27 million (R1 billion) fund has been allocated to support local production of new-energy vehicles and batteries. Starting March 1, 2026, manufacturers can claim a 150% tax deduction on qualifying investments in EV and hydrogen vehicle production, with the goal of spurring 30 billion rand in private investment.

Additionally, over $54.27 billion (R1 trillion) is earmarked for energy and road infrastructure projects aimed at stabilizing the power grid and expanding charging networks. While high upfront costs and import duties remain barriers to affordability, EVs promise significant savings – operational costs are 70% lower, and maintenance costs are reduced by 30% compared to traditional combustion vehicles. South Africa’s public charging infrastructure is also notable, with a ratio of 1 charger for every 4.98 EVs, exceeding the global benchmark of 1:10. However, most of this infrastructure is concentrated in urban areas.

sbb-itb-09752ea

Factors Driving Market Changes in 2025

South Africa’s automotive market experienced a significant transformation in 2025, shaped by shifts in affordability, evolving consumer demographics, and a recovery in manufacturing. These factors combined to create a dynamic environment for both buyers and manufacturers.

Affordability and Economic Conditions

Economic stability played a key role in boosting consumer confidence. New vehicle inflation hit a record low of just 1.5% in Q3 2025, making cars more accessible and sparking fierce competition among brands to attract buyers. Lower interest rates and a stronger rand further enhanced purchasing power, leading to robust growth in passenger vehicle sales.

However, affordability remained uneven across income groups. High-income households, earning over $10,850 per month (R200,000+), showed 34% intent to purchase vehicles, while the general population lagged behind at just 17%. This disparity fueled a surge in demand for budget-friendly options, with Chinese brands like JAC, GWM, Mahindra, and Chery leading the charge. These brands expanded their market share rapidly, growing up to nine times faster than the industry average, with volume increases ranging from 35% to 67%. Lee Naik, CEO of TransUnion Africa, highlighted this trend:

"Affordability and choice are redefining South Africa’s automotive landscape. Consumers are seeking greater value and flexibility and manufacturers that meet this demand through innovation and pricing discipline are winning the race for growth".

These economic conditions also influenced the profile of car buyers, signaling a shift in consumer behavior.

Changing Buyer Demographics and Preferences

Younger generations emerged as dominant players in the market. Gen Z reported 21% purchase intent, with Millennials close behind at 19%, outperforming older age groups. These younger buyers also leaned toward flexible ownership models like leasing and subscriptions, moving away from the traditional preference for long-term ownership.

The electrification trend revealed a stark divide along income lines. While 75% of high-income buyers explored plug-in hybrids, lower-income consumers continued to favor internal combustion engines due to the high upfront costs of electric vehicles. Among Gen Z buyers, there was notable enthusiasm for hybrids, with 55% expressing interest, while 32% considered battery-electric vehicles. These generational and income-based differences reshaped manufacturer priorities, influencing how vehicles were designed and marketed. This evolving consumer landscape also supported growth in vehicle exports.

Vehicle Export Recovery

Exports played a vital role in stabilizing South Africa’s automotive industry. After earlier contractions, the recovery in manufacturing for foreign markets provided much-needed momentum. This rebound had a direct impact on dealer confidence, reflected in the RMB/BER Motor Traders Confidence Index, which climbed to 54 in Q3 2025, surpassing the neutral 50-point mark for only the second time that year. The resurgence in exports underscored the competitiveness of South Africa’s automotive manufacturing sector on the global stage, helping to maintain stability in the domestic market even as local demand fluctuated.

Challenges and 2026 Projections

Economic and Regulatory Obstacles

Even with strong sales in 2025, the road ahead is far from smooth. Affordability remains a significant hurdle, as highlighted by a 1.56:1 used-to-new financing ratio. This trend shows that more consumers are leaning toward pre-owned vehicles, which could dampen new vehicle sales in 2026. Although new vehicle inflation dropped to a record low of 1.5% in Q3 2025, consumer purchase intent also fell, sliding from 19% to 17%. This mismatch suggests that the 2025 sales boost was more about pent-up demand and aggressive dealer incentives than a genuine increase in consumer buying power.

Electrification adds another layer of complexity. Wealthier buyers are opting for plug-in hybrids, while lower-income consumers stick with traditional combustion engines, held back by high upfront costs and limited charging infrastructure. Marcia Mayaba, Sales Vice President at TransUnion South Africa, summarized the situation:

"South Africa’s automotive sector is facing a complex mix of improved macroeconomic conditions and ongoing affordability hurdles".

This paints a picture of cautious optimism and segmented growth as 2026 approaches.

Dealer Confidence Levels

Dealer confidence mirrors these economic and regulatory challenges. While the RMB/BER Motor Traders Confidence Index climbed to 54 in late 2025 – marking only the second positive reading of the year – consumer intent remains fragile at just 17%. This suggests that 2026 sales may rely heavily on fleet renewals and continued dealer incentives.

Despite these concerns, there are some encouraging signs. Macroeconomic stability, including easing interest rates, a stronger rand, and a rebound in passenger vehicle exports (up 63.7% in September 2025), provides a foundation for cautious optimism. However, consumer resistance to subscription-based connected car services remains high, with 76% of drivers worldwide – including South Africa – avoiding these services due to cost concerns. This reflects a broader "connectivity fatigue" among buyers.

Growth Rate Comparison Across Segments

The market’s performance varies significantly across segments, highlighting a mixed outlook for 2026. Passenger vehicles saw a 23.4% year-on-year increase in Q3 2025, reaching 111,697 units – the highest quarterly total since 2014. Chinese brands continued their strong momentum, growing by 88% to 89% and capturing over 15% of the market, thanks to competitively priced, feature-packed models. Hybrid and plug-in vehicles also surged, with over 60% growth year-on-year, driven by high-income households and younger buyers like Gen Z.

On the other hand, exports posted more modest growth of 4.1%, despite a notable spike in September. New vehicle financing grew by 12.7%, but this was overshadowed by the continued preference for used vehicles, as reflected in the 1.56:1 financing ratio.

| Segment | 2025 Growth Rate (YoY) | Key Driver/Risk |

|---|---|---|

| Passenger Vehicles | 23.4% | Boosted by pent-up demand and dealer incentives |

| Chinese Brands | 88%–89% | Rapid growth but risks market saturation |

| Hybrid/Plug-in Vehicles | 60%+ | Popular among affluent buyers; limited infrastructure |

| Exports | 4.1% | Recovery vulnerable to global trade volatility |

| New Vehicle Finance | 12.7% | Growth limited by preference for used vehicles |

Conclusion

By 2025, South Africa’s automotive market underwent a major shift, highlighted by a record-breaking Q3 with 111,697 passenger vehicles sold – a 23.4% year-over-year increase. Chinese brands made a significant impact, capturing over 15% of the market by growing nearly nine times faster than the overall industry. This shift wasn’t about sticking to traditional brand loyalties; instead, factors like affordability, advanced technology, and trust took center stage.

Younger buyers and high-income groups played a key role in driving this momentum. Gen Z and Millennials demonstrated purchase intentions more than double those of Baby Boomers. At the same time, hybrid and plug-in models gained massive traction, surging over 60%. Among affluent buyers, 75% leaned toward plug-in hybrids. However, the 1.56:1 ratio of used-to-new vehicle financing underscores the affordability challenges still faced by middle- and lower-income groups.

Consumers benefited from record-low vehicle inflation (1.5%) and competitive pricing, with options ranging from $16,700 to $50,000 (R250,000–R750,000). Flexible leasing and subscription plans, costing under $400 per month (R6,000), made vehicle ownership more accessible.

For manufacturers and dealers, the traditional focus on premium strategies is no longer enough. Lee Naik of TransUnion Africa stresses the importance of delivering value-driven and electrified solutions, especially as dealer confidence, measured at 54 on the RMB/BER Index, reflects the need to engage tech-savvy Gen Z and Millennials.

"The future belongs to brands and financiers that master both the value-driven present and the connected, electrified future".

Looking to 2026, easing interest rates and an impressive 63.7% export surge in September 2025 provide a solid foundation for growth. However, with 76% of consumers avoiding subscriptions due to connectivity fatigue, the focus must shift to delivering tangible benefits like lower premiums, predictive maintenance, and enhanced safety features. The market’s transformation signals a lasting move toward affordability, electrification, and flexible ownership models – trends that will shape the industry’s future path.

FAQs

What drove the increase in South Africa’s auto market sales in 2025?

South Africa’s auto market experienced notable expansion in 2025, driven by a mix of economic recovery and evolving consumer preferences. A stronger rand, buoyed by the country’s first credit rating upgrade in two decades, combined with lower inflation and reduced fuel prices, made vehicles more accessible. On top of that, interest rate cuts from the South African Reserve Bank lowered financing costs, while higher disposable incomes and improved consumer confidence – especially among younger buyers – fueled demand.

Other factors also shaped the market. Rental companies and fleet buyers, including both corporate and government entities, played a major role in boosting sales. Meanwhile, budget-conscious shoppers leaned toward cost-effective brands, with Chinese automakers achieving record market share. Adding to the momentum was the rising interest in electric and hybrid vehicles, as new-energy vehicle sales jumped 14% in the year’s first quarter.

What impact are Chinese and Indian automakers having on South Africa’s auto market?

Chinese automakers are making waves in South Africa’s car market, with their share projected to exceed 15% by 2025, a big leap from just 3.1% in 2022. This surge is fueled by their focus on affordable, value-packed models that resonate with budget-conscious buyers, especially in a market supported by favorable interest rates. The growing popularity of Chinese-brand passenger cars clearly reflects this trend.

Meanwhile, Indian automakers are also leaving a strong mark. By 2025, about 50% of all cars sold in South Africa are expected to be tied to India. This includes Indian brands like Mahindra and models manufactured in India for other companies, such as Maruti Suzuki’s contributions to Toyota’s popular Starlet and Urban Cruiser models. These developments are heating up competition in the low-cost car segment, pushing demand for more affordable and often locally assembled vehicles, which are shaping the future of South Africa’s automotive landscape.

What challenges are slowing the adoption of electric vehicles in South Africa?

The shift to electric vehicles (EVs) in South Africa is hitting some serious roadblocks, with high costs leading the pack. Fully electric cars face a hefty 25% import duty, a 15% VAT, and an additional ad valorem levy. Altogether, this tax load can exceed 58% of the car’s landed price. As a result, EVs often cost significantly more than their gas or diesel counterparts, making them unaffordable for many families already grappling with tight budgets and rising loan costs.

On top of that, South Africa’s energy and charging infrastructure presents another major challenge. Frequent power outages and load-shedding disrupt the reliability of charging stations. For consumers, the expense of installing private chargers is steep, while the public sector struggles to fund widespread charging networks. These energy issues, combined with limited resources, make it tough to create the infrastructure needed for EVs to thrive.

If EVs are to move beyond niche status in South Africa, tackling these hurdles – steep import taxes, unreliable charging options, and affordability concerns – will be essential.

Related Blog Posts

- SA EV Sales Growth 2025: Key Numbers

- South Africa Vehicle Exports by Type 2025

- South Africa hits decade-high new vehicle sales – market surges in October

- South Africa new-vehicle sales hit 55 000+ in October 2025 – best month in a decade