South Africa is making strides in electric vehicle (EV) adoption, but challenges remain. Here’s a quick snapshot of the current state:

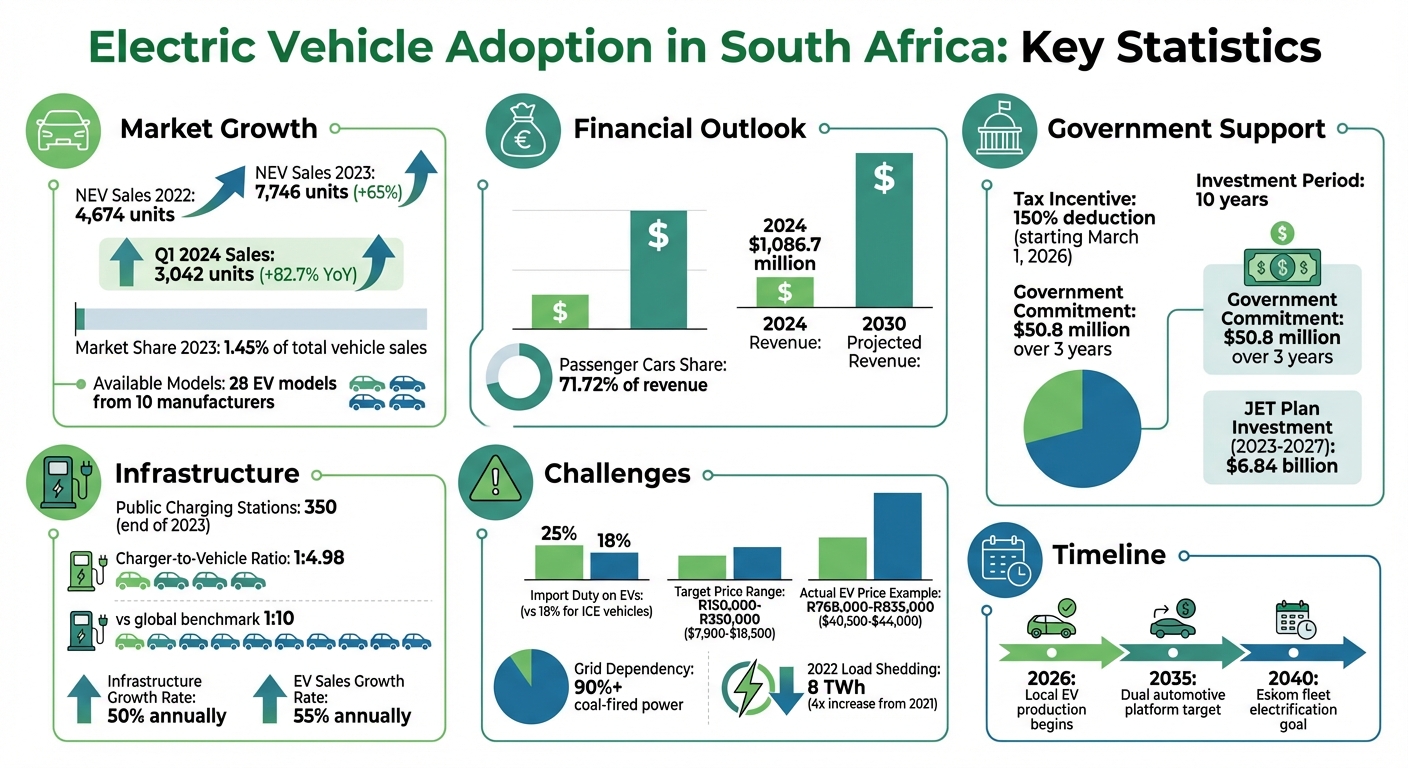

- EV Sales Growth: NEV sales jumped to 7,746 units in 2023, up 65% from 2022. Q1 2024 saw an 82.7% increase year-over-year.

- Market Share: NEVs accounted for 1.45% of total vehicle sales in 2023.

- Local Production: EV manufacturing is set to begin in 2026, supported by a 150% tax incentive for producers starting March 1, 2026.

- Charging Infrastructure: Urban areas dominate with 350 public chargers, but rural regions lag behind. Solar-powered off-grid chargers are emerging to address power issues.

- Challenges: High EV prices, 25% import duties, and unreliable power due to load shedding hinder adoption.

With government policies, private investments, and a focus on renewable energy, South Africa is preparing for a dual automotive system by 2035. However, affordability, infrastructure gaps, and energy reliability must be addressed to accelerate growth.

South Africa Electric Vehicle Adoption Statistics 2023-2024

Market Overview and Adoption Trends

EV Sales and Market Penetration

The electric vehicle (EV) market has been gaining momentum, with sales rising sharply. In 2023, the number of new energy vehicles (NEVs) sold jumped from 4,674 units in 2022 to 7,746 units, marking a significant uptick. This growth continued into early 2024, with Q1 sales reaching 3,042 units – an impressive year-on-year increase of 82.7%.

Currently, the market offers 28 EV models from 10 different manufacturers. Traditional hybrid vehicles have also seen a boost, with sales climbing from 1,408 in Q1 2023 to 2,574 in Q1 2024. Battery electric vehicles (BEVs) are making strides too, with sales increasing 85.46%, from 502 units in 2022 to 931 in 2023. Among BEVs, the Volvo XC40 Recharge stood out as a top seller, moving 150 units in 2023. Despite these gains, NEVs still account for just 1.45% of total new vehicle sales.

From a financial perspective, the EV market generated $1,086.7 million in revenue in 2024 and is on track to hit $7,062.5 million by 2030. Passenger cars are expected to dominate, contributing 71.72% of that revenue.

While these numbers highlight growth, they also reveal challenges that potential buyers face.

Consumer Preferences and Barriers

The biggest hurdle for EV adoption? Price. Most middle-class buyers are looking for vehicles priced between R150,000 and R350,000 ($7,900–$18,500), but the majority of EVs fall far outside this range. For instance, the Chinese BYD Atto 3 debuted with a price tag of R768,000 to R835,000 ($40,500 to $44,000).

"It looks as though the purchasing price of these cars has a greater impact on whether people buy them, than the price of either liquid fuel or electricity."

– Andrew Grant, Researcher, University of Cape Town

Beyond cost, "range anxiety" and concerns about the reliability of the national power grid – exacerbated by ongoing load shedding – discourage many buyers, especially those in rural areas or who frequently travel long distances. However, urban commuters find EVs appealing for their efficiency in stop-and-go traffic and their lower operating costs.

The commercial sector is also taking note, with fleet operators recognizing the economic benefits of high-mileage EVs. These developments hint at a growing but still challenging path for broader EV adoption.

Dex discusses cost as a barrier to EV adoption in South Africa

Government Policies and Incentives

South Africa has taken a production-first approach to encourage the adoption of electric vehicles (EVs), focusing on boosting local manufacturing rather than offering direct subsidies to consumers. In late 2024, Finance Minister Enoch Godongwana introduced a 150% tax incentive for companies producing electric and hydrogen-powered vehicles. Starting March 1, 2026, businesses can deduct 150% of the expenses for buildings and equipment used primarily in production during the first year.

"To encourage production of electric vehicles in South Africa, government will introduce an investment allowance for new investments, beginning 1 March 2026."

– Enoch Godongwana, Finance Minister of South Africa

This tax incentive will stay in place for 10 years, applying to qualifying assets acquired from March 1, 2026. To support this transition, the government has committed $50.8 million (R964 million) over three years, with an expected tax cost of $26.3 million (R500 million) in the 2026/27 fiscal year alone. These measures are part of the 2023 Electric Vehicle White Paper, which outlines a plan to shift the automotive industry to a dual platform – producing both internal combustion and electric vehicles – by 2035. The tax incentives also align with updates to the Automotive Production Development Program (APDP), emphasizing local value addition.

Automotive Production Development Program (APDP) 2026

The 150% tax deduction complements the Automotive Production Development Programme (APDP) Phase 2, which already offers customs duty rebates through Production Rebate Certificates. The updated program shifts its focus from overall production numbers to the Volume Assembly Localisation Allowance, encouraging manufacturers to increase local value in their production processes. This shift is crucial for South Africa’s automotive sector, especially since nearly 50% of the country’s auto exports go to the EU and UK – regions that plan to ban sales of new internal combustion engine vehicles by 2035.

BMW Group South Africa has already embraced this opportunity. In October 2024, the company began producing the fourth-generation BMW X3, including the X3 30e xDrive plug-in hybrid, at its Rosslyn plant in Pretoria for global markets. This milestone followed a $221.1 million (R4.2 billion) investment in electrifying its facilities and training its workforce.

Import Duties and Tax Incentives

While production incentives have been prioritized, consumers still face high costs. EVs are subject to a 25% import duty, compared to just 18% for internal combustion engine (ICE) vehicles. As part of its broader EV strategy, the government plans to temporarily lower import duties on batteries for vehicles that are both manufactured and sold domestically, though the specifics of this measure are still under development.

President Cyril Ramaphosa has acknowledged the importance of consumer-focused incentives, stating that "consideration must be given to incentives for manufacturers, as well as tax rebates or subsidies for consumers, to accelerate the uptake of electric vehicles".

sbb-itb-09752ea

Charging Infrastructure Expansion

Current Charging Network Coverage

South Africa’s charging network is heavily concentrated in major urban hubs like Johannesburg, Cape Town, and Durban, with little to no coverage in rural areas. By the end of 2023, the country had around 350 public charging stations. Most of these are strategically located along key highways such as the N1, N2, and N3, leaving out more remote regions.

Interestingly, South Africa currently boasts one public charging station for every 4.98 privately owned electric vehicles (EVs) – a ratio that exceeds the global benchmark of 1:10. However, this lead is narrowing as EV sales outpace the growth of charging infrastructure. While infrastructure is expanding at an annual rate of about 50%, EV sales are climbing even faster at 55%. Out of the existing public chargers, nearly 50 are free to use, mostly found at BMW service centers. This urban-centric development highlights the need for private sector initiatives to broaden the network.

Private Sector Contributions

Private companies have been the driving force behind South Africa’s charging infrastructure. For instance, in 2022, Audi South Africa partnered with GridCars to roll out 70 new charging stations across 33 locations, featuring four ultra-fast 150kW DC chargers. BMW and Mercedes-Benz have also made significant strides, with BMW establishing over 60 "ChargeNow" stations nationwide and Mercedes-Benz adding chargers at 36 dealership locations.

In a pivotal move, state utility Eskom entered the sector in August 2024. Partnering with GridCars, Eskom launched a pilot project featuring 10 charging stations across five locations: Midrand (Gauteng), Brackenfell (Western Cape), Mkondeni (KwaZulu-Natal), Rustenburg (North West), and Mbombela (Mpumalanga). These stations include 60kW DC fast chargers and 22kW AC chargers, supporting a test fleet of 20 EVs. Eskom has set its sights on electrifying its entire fleet by 2040.

"By investing in eMobility and the charging infrastructure needed for electric vehicles, we are not only reducing our carbon footprint but also stimulating the local economy and creating new opportunities for growth."

– Gabriel Kgabo, General Manager in the Office of the Eskom Group Executive for Distribution

Challenges in Scaling Infrastructure

South Africa’s persistent load shedding poses a major hurdle to expanding charging infrastructure, disrupting operations and reliability. To address this, developers are exploring off-grid solutions. In March 2025, CHARGE introduced the country’s first off-grid, solar-powered EV charging station in Wolmaransstad, North West province. This station is part of a broader plan to establish a network of 120 solar-powered chargers, enabling long-distance travel without depending on Eskom’s grid.

Another challenge is the lack of standardized charging protocols across private networks. This inconsistency creates a fragmented experience for EV owners, who often face difficulties using chargers from different providers. Additionally, the uneven distribution of charging stations leaves rural areas underserved, exacerbating range anxiety for drivers.

Energy Challenges and Environmental Impact

Load Shedding and Reliability Concerns

As the adoption of electric vehicles (EVs) gains momentum, ensuring a reliable energy supply becomes crucial to maintaining consumer trust. In South Africa, more than 90% of the electricity grid relies on aging coal-fired power plants. These plants face severe capacity issues, leading to frequent load shedding. In 2022 alone, over 8 terawatt-hours (TWh) of electricity were shed – a staggering fourfold increase compared to the previous year.

Load shedding disrupts grid-connected EV chargers, which has become a significant concern for potential buyers. In fact, 37.9% of EV purchasers have identified this as a major drawback. The inability to reliably charge vehicles during outages makes EVs seem less practical for everyday use.

"Load shedding creates significant uncertainty for users, who may find charging stations inoperative during peak outages." – Anari Energy

Additionally, South Africa’s coal-dependent grid diminishes the environmental benefits of EVs. Charging an EV using this grid can actually result in more carbon emissions than driving a new internal combustion engine vehicle. These challenges underscore the pressing need for a cleaner and more dependable energy system, pushing the focus toward renewable energy solutions.

Transition to Renewable Energy

To address these issues, the South African government is prioritizing renewable energy as part of its broader strategy. Transport electrification has become a key component of the Just Energy Transition (JET) plan, which aims to build a low-carbon economy. Between 2023 and 2027, the plan anticipates investments of approximately 128.1 billion rand ($6.84 billion) to decarbonize the transport sector. These efforts align with policies promoting local EV production and the expansion of charging infrastructure.

Progress is already evident. In late 2023, the World Bank and African Development Bank approved nearly $500 million for a hybrid energy project. This initiative includes decommissioning one of the country’s oldest coal-fired power plants and replacing it with 220 MW of solar and wind energy, along with 150 MW of battery storage. By 2024, six hybrid projects – integrating solar, wind, and battery storage – had signed agreements with Eskom. Three of these projects, with a combined capacity of 150 MW, are already operational under 15-year power purchase agreements.

"Decarbonisation should not lead to de-industrialisation but rather be leveraged for growth, deepening the automotive value chain, fostering growth of the local industry, and ensuring the transition aligns with economic priorities." – Ebrahim Patel, Minister of Trade, Industry and Competition

The government has also introduced the South African Renewable Energy Masterplan (SAREM) to guide the expansion of renewable energy capacity. Additionally, dedicated tenders for utility-scale battery storage have been launched to stabilize the grid. These initiatives aim to ensure that by 2035, when the automotive industry shifts to a dual platform that includes EVs, charging infrastructure will be powered by renewable energy instead of coal.

Conclusion

South Africa is gearing up for a major transformation in its automotive industry, aiming to establish a dual automotive platform by 2035 to maintain access to crucial export markets. The numbers are already showing momentum – NEV sales jumped by 83% in the first quarter of 2024, and local EV production is set to kick off in 2026. Backing this shift, the government has pledged $6.84 billion in investments and introduced a 150% tax allowance for qualifying projects starting March 1, 2026. Private efforts are also gaining traction, with initiatives like Golden Arrow Bus Services planning to roll out 60 electric buses annually and GridCars expanding its network to over 450 charging stations.

However, this progress comes with significant hurdles. Ongoing load shedding and the steep upfront costs of EVs remain barriers for many consumers. Additionally, South Africa’s reliance on a coal-heavy energy grid could undermine the environmental benefits of electric vehicles. The shift also poses a risk to over 100,000 jobs tied to the traditional automotive value chain.

Tackling these challenges will require a united effort. Collaboration among stakeholders is critical to turning obstacles into opportunities. The government needs to expand consumer incentives, private companies should focus on building charging networks powered by renewable energy, and consumers must weigh the long-term savings EVs can deliver despite the initial investment.

South Africa’s wealth of resources – platinum, manganese, nickel, and cobalt – presents a unique chance to create a competitive battery manufacturing industry. By leveraging these assets, the country can turn current challenges into a foundation for sustainable industrial growth.

FAQs

What challenges are slowing down the adoption of electric vehicles in South Africa?

South Africa faces several hurdles in embracing electric vehicles (EVs). One of the most pressing issues is the limited charging infrastructure. Outside of major cities, fast-charging stations are scarce, leaving potential buyers worried about running out of battery power – a concern often referred to as "range anxiety."

Another significant barrier is the high cost of EVs. With import duties set at 25%, EVs become far more expensive, putting them out of reach for many households already dealing with tight budgets. The absence of targeted subsidies only adds to the affordability challenge, making EV ownership a distant dream for many.

Adding to these challenges are the country’s energy struggles. Frequent power outages and an aging, underdeveloped grid make reliable charging a concern, casting doubt on the practicality of owning an EV in such conditions.

To overcome these obstacles, South Africa will need to focus on a few key areas: expanding the charging network, introducing financial incentives, and finding ways to bring down costs – whether by reducing import duties or encouraging domestic EV manufacturing. Without these efforts, widespread EV adoption will remain a challenge.

What steps is the South African government taking to support local electric vehicle production?

The South African government has taken bold steps to promote local electric vehicle (EV) production, offering tax breaks and implementing forward-thinking policies. In December 2025, President Cyril Ramaphosa signed a law that provides EV and hydrogen vehicle manufacturers with a 150% tax deduction on costs related to new buildings and equipment primarily used for production. This incentive applies to assets brought into use after March 1, 2026, and will remain available for a decade. To support this initiative, the government has allocated $52.6 million over a three-year period.

In addition, a White Paper on EVs was introduced in December 2023, outlining the country’s plan to transition its automotive sector to focus on EVs by 2035. The roadmap includes investment allowances for EV-related capital expenditures and funding under the Just Energy Transition plan, aimed at advancing low-carbon transportation solutions. These efforts are designed to build a thriving EV manufacturing ecosystem in South Africa, attracting both well-established companies and emerging businesses to invest in this growing industry.

How does load-shedding affect EV charging in South Africa?

Load-shedding, the scheduled power outages in South Africa caused by energy shortages, poses a major hurdle for the country’s EV charging infrastructure. Charging stations depend on a consistent electricity supply, and frequent outages disrupt this flow, causing delays and leaving EV owners frustrated.

To minimize these disruptions, charging station operators often turn to expensive backup options like generators or battery storage systems. While these solutions help maintain operations, they also drive up the cost of running the network. On top of that, the uncertainty surrounding power availability can shake consumer confidence. Many potential EV buyers may hesitate to make the switch, worried about whether they’ll have reliable access to charging during outages.

Related Blog Posts

- SA EV Sales Growth 2025: Key Numbers

- Electric vs Petrol: Trends in South Africa

- South Africa’s EV Policies: Renewable Charging Impact

- Tax Incentives for EV Manufacturing in South Africa