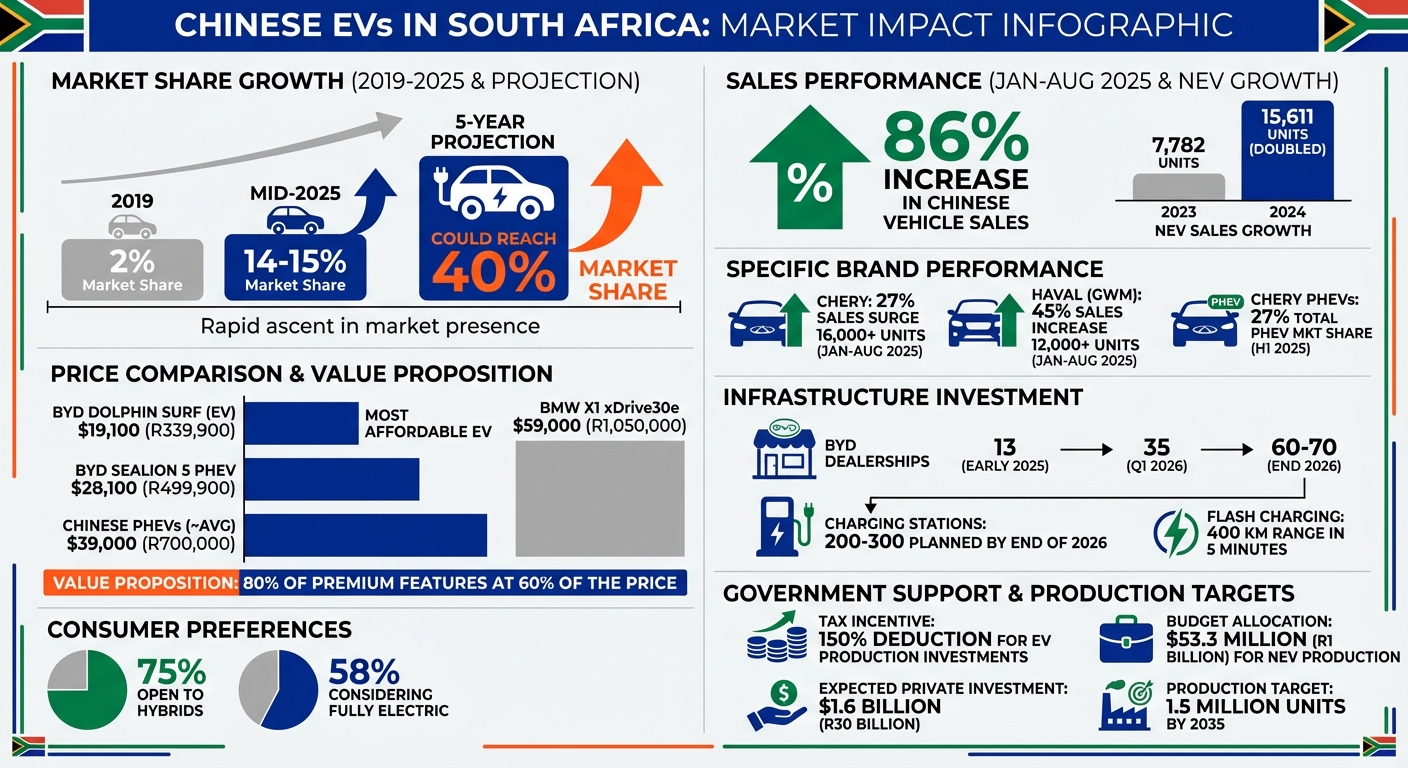

Chinese electric vehicles (EVs) are reshaping South Africa’s car market by offering affordable, feature-rich options that cater to local challenges like unreliable electricity and limited charging infrastructure. Key takeaways:

- Affordability: Chinese EVs, like the BYD Dolphin Surf priced at $19,100, are significantly cheaper than Western models, making EVs accessible to middle-class buyers.

- Hybrid Focus: Plug-in hybrids (PHEVs) are prioritized over fully electric vehicles due to South Africa’s inconsistent power grid, offering flexibility and reliability.

- Market Growth: Sales of new energy vehicles (NEVs) doubled from 2023 to 2024, with Chinese automakers capturing 14-15% of the market by mid-2025.

- Local Investment: Brands like BYD and Chery are expanding dealerships and exploring local assembly plants to reduce costs and grow their footprint.

- Government Support: Tax incentives and funding for EV production are encouraging growth, with projections for 1.5 million vehicle units by 2035.

Chinese automakers are challenging established brands, offering advanced features at lower prices, and focusing on building infrastructure to support EV adoption. This shift is driving competition and transforming South Africa into a hub for EV expansion across Africa.

Chinese EV Market Growth in South Africa: Key Statistics and Projections

Why Chinese EVs Are More Affordable and Competitive

Lower Price Points

Chinese automakers are making waves in South Africa by offering electric vehicles (EVs) at prices that legacy brands struggle to match. Back in China, a fierce price war – where companies like BYD slashed prices by up to 34% in early 2025 – has pushed manufacturers to accept thinner margins domestically while keeping their export prices highly attractive. This strategy allows them to deliver vehicles packed with premium features at prices far below their Western counterparts.

"For BYD, they are in a pricing war at home but not overseas. They make plenty of money outside [of China] with margins that are very profitable." – Mark Greeven, Professor of Innovation, IMD Business School

The results are striking. For instance, while a BMW X1 xDrive30e plug-in hybrid is priced around R1,050,000 ($59,000), comparable Chinese plug-in hybrids are entering the market at or below R700,000 ($39,000). The BYD Dolphin Surf, launched in September 2025 at R339,900 (about $19,100), became South Africa’s most affordable new EV, making EV ownership accessible to middle-class families.

To further reduce costs, Chinese manufacturers are investing in local infrastructure. By partnering with South African dealerships and exploring local assembly plants, they aim to streamline distribution and avoid the hefty 25% import duty on EVs. BYD, for example, plans to expand its dealership network from 13 to 35 locations by the end of 2026. This combination of competitive pricing and strategic investments makes Chinese EVs an increasingly attractive option.

Advanced Features and Technology

Chinese EVs don’t just compete on price – they also deliver exceptional value through advanced features. Unlike legacy brands that often charge extra for premium add-ons, Chinese automakers include them as standard. Features like 360-degree cameras, digital dashboards, and panoramic roofs, which can add up to R100,000 ($5,600) to the price of Western vehicles, come included in the base models of brands like Haval and Chery.

"The value proposition with them is just so, so good, so superior to legacy automakers. Chinese brands have a different strategy, the cars come fully loaded, what you see is what you get, and the technology is great." – Ciro De Siena, Journalist, Cars.co.za

Beyond physical features, these vehicles excel in smart connectivity and software. They offer seamless phone app integration and advanced digital features, often rivaling those of premium European models. Autonomous driving capabilities, typically sold as costly add-ons by other brands, are frequently included at no extra charge. Analysts estimate that Chinese EVs deliver around 80% of the features found in premium models but at only 60% of the price.

To address concerns about quality, Chinese manufacturers back their vehicles with comprehensive warranties, including some lifetime engine warranties, providing long-term value and peace of mind. This focus on technology and reliability strengthens their appeal in global markets.

Hybrid Options for South African Conditions

South Africa’s inconsistent electricity supply and limited charging infrastructure present challenges for EV adoption. Recognizing this, Chinese automakers are prioritizing plug-in hybrids (PHEVs) as a practical solution. These vehicles offer a bridge to full electrification by combining battery power with internal combustion engines, ensuring drivers aren’t left stranded when charging options are scarce.

Surveys show that nearly 75% of prospective South African buyers are open to hybrids, compared to 58% considering fully electric vehicles. Hybrids provide the reliability needed in a country where the power grid can’t always be counted on.

"Battery electric vehicles have not really taken off in South Africa. We’ve gone the route of looking more towards traditional hybrids or plug-in hybrids." – Hans Greyling, General Manager, Omoda & Jaecoo South Africa

To meet this demand, Chinese brands have rolled out a variety of PHEV models. In June 2025, Chery South Africa launched its "Super Hybrid" range in Johannesburg, featuring eight hybrid models designed for local conditions. These efforts paid off, with Chery’s PHEV models capturing 27% of the total PHEV market share in the first half of 2025, surpassing their entire 2024 sales.

BYD has also introduced models tailored for South African drivers, such as the Shark pickup truck and the SEALION 6 crossover. These vehicles offer the long-distance capabilities and utility that many South Africans need, without relying solely on the power grid. The BYD Sealion 5 PHEV, priced at R499,900 ($28,100), delivers versatility at a fraction of what European competitors charge.

China’s BYD Plans 200 to 300 Charging Stations in South Africa by End 2026

Major Chinese Brands Entering South Africa

Chinese automakers are making waves in South Africa, leveraging competitive pricing and cutting-edge technology to establish a strong foothold in the market. Beyond affordability, these brands are focusing on building local service networks and rolling out charging solutions to enhance their appeal.

BYD: Leading the Charge

BYD has emerged as a frontrunner in South Africa, rapidly expanding its dealership network and offering a diverse range of vehicles. Starting 2025 with 13 dealerships, the company plans to grow this to 35 by the first quarter of 2026, with a goal of reaching 60–70 locations by the end of the year. This aggressive expansion ensures extensive sales and service coverage across the country.

"By the end of the year, we will have about 20 dealerships around the country. The aim is to expand that to about 30, 35 the next year." – Steve Chang, General Manager, BYD Auto South Africa

BYD’s lineup caters to various price points, from the entry-level Dolphin Surf to the premium Seal sedan, priced at $56,200 (R999,900). This positions the brand as a compelling option in the electric sedan market. Beyond vehicles, BYD is heavily investing in charging infrastructure, with plans to install 300 fast-charging stations along South African highways by the end of 2026. These stations will feature BYD’s proprietary Flash Charging technology, capable of delivering 400 km (248 miles) of range in just five minutes using up to 1 MW of power. To address the challenges of South Africa’s unreliable power grid, BYD is also exploring solar-powered charging stations in collaboration with Eskom.

"BYD is not just selling cars; we are investing in South Africa’s automotive future and creating jobs." – Stella Li, Executive VP, BYD

Other Chinese Brands Gaining Traction

While BYD sets the pace, other Chinese automakers are quickly establishing themselves with competitive offerings.

Chery has become South Africa’s second-largest Chinese automotive brand, with sales surging by 27% to over 16,000 units between January and August 2025. Its hybrid models are gaining traction, capturing 27% of the plug-in hybrid market share in the first half of 2025 – already surpassing its total sales for 2024. The entry-level Tiggo 4, priced at $15,700 (R279,900), is one of the most affordable new vehicles available. Chery is also exploring local manufacturing to support broader exports across Africa.

"We treat South Africa as a very important market for our global expansion… a gateway to the African continent." – Tony Liu, CEO, Chery South Africa

Great Wall Motor (GWM) is making strides through its Haval and Ora sub-brands. Haval alone recorded a 45% increase in sales, with over 12,000 units sold in the first eight months of 2025. GWM is also considering semi-knockdown local assembly to take advantage of government incentives.

Chery’s premium sub-brands, Omoda & Jaecoo, have already established over 50 dealerships across Southern Africa, catering to buyers seeking high-end features at competitive prices. Meanwhile, newer entrants like Dongfeng, Leapmotor, Dayun, Changan, and GAC are gearing up to launch or expand their operations in 2026. Among them, Dayun’s Yuehu S5 – priced at $22,500 (R399,900) – stands out as the most affordable electric vehicle in the market.

Collectively, Chinese automakers achieved an 86% increase in sales between January and August 2025, securing a 15% share of South Africa’s total automotive market.

sbb-itb-09752ea

EV Infrastructure and Government Support

South Africa’s electric vehicle (EV) market faces two major challenges: limited charging infrastructure and an unstable power grid. Chinese automakers, particularly BYD, are stepping up to address these hurdles by investing heavily in charging networks. At the same time, the South African government is rolling out financial incentives to encourage EV adoption. Together, these initiatives are poised to reshape the market and build consumer confidence.

Charging Network Expansion

BYD has ambitious plans to establish 200–300 public charging stations across South Africa by the end of 2026. Starting in April 2026, they will also launch their "Flash" charging technology, which can deliver 400 km (approximately 248 miles) of range in just five minutes. This kind of rapid charging could eliminate one of the biggest deterrents to EV ownership – long charging times.

"We want to cover 100% of the country." – Stella Li, Executive Vice President, BYD

In a significant move, BYD partnered with Eskom, South Africa’s state-owned utility, in September 2025 through a Memorandum of Cooperation. This partnership focuses on expanding public charging infrastructure and exploring vehicle-to-grid (V2G) technology, which could help stabilize the nation’s power supply. To tackle the challenges of an unreliable grid and frequent load shedding, BYD plans to integrate solar energy and on-site battery storage into its charging stations. These stations will be strategically located at dealerships, in major cities, and along national highways. Such investments are expected to create a more reliable and accessible charging network, paving the way for broader EV adoption.

Government Incentives and Tax Policies

In December 2024, the South African government introduced a 150% tax deduction for investments in electric and hydrogen vehicle production. This tax amendment, signed by President Cyril Ramaphosa, has already sparked interest, with three Chinese automakers signing non-disclosure agreements with the Automotive Business Council to explore local manufacturing opportunities.

The 2025 National Budget allocated $53.3 million (R1 billion) to support the production of new-energy vehicles, batteries, and related projects. This funding is expected to attract an additional $1.6 billion (R30 billion) in private sector investment. Furthermore, the government is temporarily reducing import duties on batteries for vehicles manufactured locally.

"With good government policies, we will attract new investment, we will increase and retain investment." – Mikel Mabasa, CEO, Automotive Business Council

These government measures lower operational costs and enhance the appeal of Chinese EVs in the South African market. Together, the efforts of Chinese automakers and the government are setting the stage for a significant shift toward EV adoption in South Africa’s automotive industry.

How Chinese EVs Will Impact the Market

Shifts in Consumer Preferences

In South Africa, more buyers are leaning toward plug-in hybrids and traditional hybrids rather than fully electric vehicles. This shift stems from practical concerns about power reliability and charging infrastructure. Sales of New Energy Vehicles (NEVs) have soared, doubling from 7,782 units in 2023 to 15,611 units in 2024. Chinese automakers are making waves by offering feature-packed vehicles at prices under R400,000 (around $22,500). These affordable options are opening the doors of electrified transportation to middle-class consumers who may have previously found such vehicles out of reach. With competitive pricing, Chinese models are challenging established brands and reshaping consumer expectations. This dynamic is prompting many buyers to rethink their loyalty to legacy brands, pushing traditional automakers to revisit their strategies in response to the changing market.

Increased Competition for Established Automakers

The rise of Chinese EVs is not just shifting consumer demand – it’s also intensifying competition for traditional automakers. German brands, for example, have seen their market share in South Africa plummet by nearly 70% over the past decade. Meanwhile, Chinese brands have surged from holding just 2% of the market in 2019 to an impressive 14% by mid-2025. Between January and August 2025 alone, sales of Chinese vehicles jumped by 86%.

Faan van der Walt, CEO of WeBuyCars, predicts a dramatic shift, stating:

"Chinese brands could capture as much as 40% of South Africa’s vehicle market within the next five years"

What’s driving this momentum? Beyond affordability, Chinese EVs require significantly less maintenance – no oil changes and fewer moving parts – disrupting the traditional dealership model that has long relied on servicing internal combustion vehicles for profit. The influx of these budget-friendly models is also affecting the resale market, driving down the value of 3- to 4-year-old Japanese and German cars.

Future Market Projections

Industry leaders believe South Africa is approaching a turning point. Tony Liu, CEO of Chery South Africa, explained:

"Based on our experience in China, once the market share of new energy vehicles reaches almost 10%, then the demand will start to explode"

With government incentives recently introduced, projections suggest that automotive production in South Africa could climb to 1.5 million units by 2035. Chinese automakers see South Africa as a strategic entry point into the broader African market. The country’s well-established automotive infrastructure makes it an ideal hub for expansion into neighboring markets like Tanzania, Zambia, and Namibia. To further strengthen their position, several Chinese manufacturers are exploring local assembly plants to take advantage of government support. Steve Chang, General Manager of BYD Auto South Africa, emphasized:

"South Africa and the rest of Africa have a very big opportunity to what I call leapfrog from ICE into renewable energy (cars)"

The market is on the brink of a significant transformation, with ripple effects likely to extend far beyond South Africa, reshaping the automotive landscape across the African continent.

Conclusion

Chinese electric vehicles are shaking up South Africa’s automotive market by offering affordable, tech-packed options that make electric transportation more accessible to middle-class buyers. Their competitive pricing bridges a gap for consumers who were previously unable to afford EVs, while a dual-powertrain approach helps address challenges like power outages and limited charging infrastructure. On top of these advantages, Chinese EV makers are benefiting from supportive policies and infrastructure improvements that make entering the market easier. For example, BYD is planning an ambitious dealership rollout, aiming for 30–35 locations by 2026, and the South African government is encouraging investment with a 150% tax deduction for qualifying projects.

This growing presence is creating stiff competition for established automakers, with Chinese brands rapidly gaining ground. Industry leaders foresee major changes ahead. Tony Liu, CEO of Chery South Africa, highlighted this momentum:

"Based on our experience in China, once the market share of new energy vehicles reaches almost 10%, then the demand will start to explode."

With South Africa emerging as a potential gateway to the broader African market and discussions underway about setting up local assembly plants, the automotive industry is on the verge of a major transformation. Experts project that Chinese manufacturers could secure up to 40% of the market within the next five years, signaling a shift that will redefine consumer choices, competition, and infrastructure development in the region for years to come.

FAQs

How are Chinese EV manufacturers helping improve South Africa’s charging infrastructure?

Chinese electric vehicle (EV) manufacturers are stepping up to tackle South Africa’s limited charging infrastructure by building fast-charging networks. Take BYD, for instance – a major player in the EV market. Starting in mid-2026, BYD plans to launch high-power public charging stations, with 200–300 stations expected to be operational by the end of the year. These chargers are impressive, capable of delivering about 250 miles of range in just five minutes, which takes much of the stress out of worrying about running out of charge.

To make EV charging even more convenient, Chinese automakers are placing chargers in strategic locations like dealerships and busy public areas. This smart placement not only addresses the challenges of South Africa’s often unreliable power grid but also makes EVs a more practical option for everyday drivers. By focusing on these critical infrastructure gaps, Chinese brands are positioning themselves as leaders in South Africa’s shift toward electric mobility.

Why are Chinese electric vehicles (EVs) generally more affordable than Western models?

Chinese EVs tend to be easier on the wallet, thanks to efficient production techniques and a focus on providing feature-rich vehicles at competitive prices. Many manufacturers in China take advantage of large-scale production, simplified supply chains, and lower labor costs, which help keep their expenses down.

On top of that, these companies emphasize delivering loaded models – think cutting-edge tech, impressive battery ranges, and extended warranties – at prices that often beat their Western rivals. This approach appeals to cost-conscious buyers who still want modern, dependable electric vehicles.

How is South Africa encouraging Chinese electric vehicle manufacturers to invest in the country?

The South African government is making bold moves to attract Chinese electric vehicle (EV) manufacturers by introducing generous tax incentives and building partnerships. Starting in March 2026, a new law will offer a 150% tax deduction on the cost of buildings and equipment used to produce electric or hydrogen-powered vehicles. This initiative is crafted to make local assembly and production more financially enticing for Chinese automakers.

Beyond tax incentives, government officials are actively reaching out to Chinese manufacturers, urging them to set up local production facilities and invest in hybrid and EV technologies. The goal is twofold: to establish South Africa as a key gateway for entering the broader African market and to speed up the country’s transition to cleaner transportation options.

Related Blog Posts

- SA EV Sales Growth 2025: Key Numbers

- Chinese EV brands gain momentum in South African market

- Leapmotor EVs Land in South Africa: Affordable Electric Cars Are Finally Here ⚡🇿🇦

- Inside Leapmotor’s South African Launch – What It Means for Local EV Buyers