South Africa’s businesses are turning to electric vehicles (EVs) to save costs and address fuel price concerns. Two EV models, Spiro and BasiGo, are gaining attention for fleet use, each designed for different needs:

- Spiro: Electric motorcycles with a battery-swapping system (713+ stations in 8 African countries). However, its network isn’t yet available in South Africa.

- BasiGo: Electric buses and vans offering longer ranges (up to 500 km daily) and fast charging (1.5–2 hours), but requiring dedicated charging depots.

Key Takeaways:

- Spiro suits smaller, last-mile delivery fleets with quick battery swaps but limited range and payload capacity.

- BasiGo is better for larger fleets needing higher capacity and range, though it demands more infrastructure investment.

Quick Comparison:

| Feature | Spiro | BasiGo |

|---|---|---|

| Vehicle Type | Motorcycles | Vans (Ma3e) & Buses (E9) |

| Daily Range | 75–90 km | Up to 500 km (Ma3e), ~400 km (E9) |

| Charging Time | Instant battery swap | 1.5–2 hours (fast charge) |

| Infrastructure | Battery swap stations | Dedicated charging depots |

| Best For | Small fleets, short trips | Large fleets, long routes |

For fleet managers, starting with pilot programs can help fine-tune strategies before full EV adoption. South Africa’s growing EV infrastructure and government incentives from 2026 will further support this transition.

Episode 154: The Truth about EV Costs: The Good, The Bad, and the Ugly Pt2 #podcast #evs

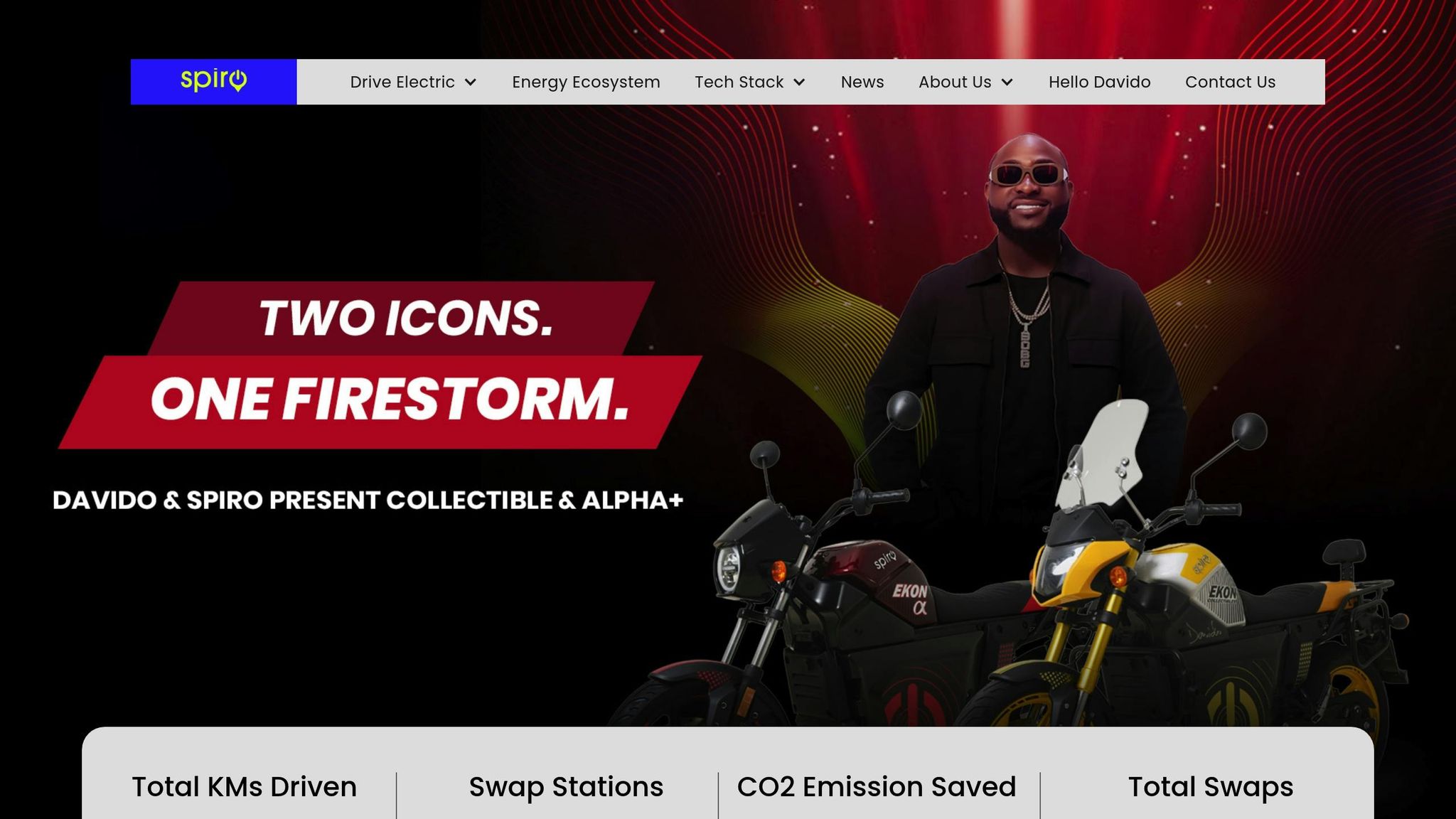

1. Spiro

Spiro is active in eight African countries, including Kenya, Uganda, Tanzania, Rwanda, Nigeria, Benin, Togo, and Cameroon. Across these regions, the company operates an impressive 713 battery swap stations, offering a different approach to powering electric vehicles compared to traditional charging methods.

That said, Spiro’s network currently doesn’t cover South Africa. This means fleet operators in South Africa will need to wait for the company to establish the necessary infrastructure before they can benefit from its battery swap model.

2. BasiGo

Unlike Spiro’s well-documented network, reliable information about BasiGo’s electric buses is still pending. Key details such as specifications, range, charging technology, efficiency, market reach, and maintenance processes have yet to be confirmed. Further updates will be provided once verified data becomes available.

sbb-itb-09752ea

Advantages and Disadvantages

When South African fleet operators weigh the adoption of electric vehicles, they encounter distinct trade-offs between Spiro’s motorcycle solutions and BasiGo’s bus and van offerings. Each approach brings its own set of strengths and challenges, influencing both operational efficiency and cost management. Here’s a closer look at the pros and cons of each.

Spiro’s Motorcycle Fleet

Spiro’s standout feature is its battery swapping network, which eliminates downtime by allowing depleted batteries to be exchanged instantly. In contrast, a traditional full recharge can take up to four hours. However, with a range of just 75 to 90 kilometers per charge, these motorcycles may require frequent swaps on longer routes. Additionally, their design limits them to smaller payloads and excludes passenger transport, which could restrict their versatility in certain operations.

BasiGo’s Bus and Van Fleet

BasiGo caters to higher-capacity needs with vehicles like the Ma3e van, capable of covering up to 300 kilometers per charge and offering up to 500 kilometers of daily operation. Meanwhile, the E9 Kubwa bus supports around 400 kilometers of daily use. Equipped with DC fast charging, these vehicles can be fully recharged in 1.5 to 2 hours. On the downside, BasiGo’s system requires a dedicated depot for its charging infrastructure, and its larger vehicles might not be ideal for operators managing smaller fleets or shorter routes.

| Comparison Factor | Spiro | BasiGo |

|---|---|---|

| Vehicle Types | Electric motorcycles | Electric vans (Ma3e) and buses (E9 Kubwa) |

| Daily Range | 75–90 km per charge | Ma3e: Up to 500 km daily E9 Kubwa: ≈400 km daily |

| Charging Time | Instant battery swap / 4 hours (full charge) | Approximately 1.5–2 hours (full charge) |

| Infrastructure | 713+ battery swap stations | DC fast charge depot network |

| Cost Savings | Over 35% fuel savings, 40% lower maintenance | Substantial fuel cost reductions |

| Fleet Scalability | High (pay-as-you-go model) | Moderate (requires dedicated depot infrastructure) |

This breakdown highlights the key factors operators must consider when deciding which solution aligns best with their operational requirements. Each model addresses different needs, from payload and range to infrastructure and scalability, offering tailored options for diverse fleet demands.

Final Assessment

Both Spiro and BasiGo present strong options for South African fleet operators looking to transition to electric vehicles. Their success, however, will hinge on tailoring each solution to meet specific operational requirements.

Diving into real-world results, fleet electrification has already demonstrated clear financial benefits. For instance, Takealot‘s fleet of 11 JAC e-trucks reported an average Total Cost of Ownership (TCO) savings of 12.75% within the first five months of 2024. On top of that, energy optimization strategies and driver training programs led to a 39% drop in energy consumption per kilometer. With proper planning and execution, similar cost and energy reductions could be achieved across other fleet operations.

For smaller operators, such as last-mile delivery services, couriers, and urban logistics providers, Spiro’s low upfront cost and straightforward deployment make it an attractive choice. On the other hand, larger fleet operators, particularly those with established depot facilities, may find BasiGo better suited to their needs. BasiGo offers the range and capacity required for passenger transport and cargo hauling, especially when paired with smart charging systems that can lower energy costs by 40–65%.

South Africa’s EV infrastructure is also advancing to support this transition. Eskom‘s pilot project, featuring 20 electric vehicles and 10 charging stations, is part of a broader plan to electrify its entire fleet by 2040. Furthermore, the National Treasury‘s recent incentives to promote local EV production starting in 2026 are expected to enhance vehicle availability while driving down costs.

To get started, fleet operators should consider launching pilot programs with a limited number of vehicles. Testing specific routes, charging hardware, and driver training while gathering TCO data will help businesses refine their strategies. This phased approach allows operators to identify the most effective infrastructure and deployment methods for their unique needs before committing fully to electrification.

Ultimately, the best choice depends on your fleet’s size and operational priorities. Select the model that aligns most closely with your goals and requirements.

FAQs

What are the main differences between Spiro’s electric motorcycles and BasiGo’s electric buses and vans in terms of infrastructure and operations?

Spiro’s electric motorcycles are designed with compactness in mind, making them easy to manage and perfect for shorter trips. They only require basic charging stations, which keeps infrastructure needs simple. Plus, they’re affordable to run and maintain, offering a practical choice for quick rides and fast turnarounds. Their smaller size and shorter range streamline logistics and allow for quicker recharging times.

In contrast, BasiGo’s electric buses and vans come with different demands. These vehicles need more advanced infrastructure, such as high-capacity charging stations and depot facilities, to support their larger batteries and longer operating hours. Managing these vehicles involves scheduled charging and routine maintenance to keep them running efficiently, especially for long-distance routes or high-demand operations. They’re a great fit for businesses focused on scalable and sustainable transportation solutions.

What can South African fleet operators do to address the limited availability of Spiro battery swap stations?

South African fleet operators have the opportunity to tackle the challenge of limited Spiro battery swap stations by considering solutions designed specifically for the local landscape. One promising approach is the development of battery-swapping stations powered by renewable energy sources like solar or wind. These setups are already being tested and could play a key role in closing the infrastructure gap.

Another option gaining traction is the adoption of smart battery-swapping services. These systems provide a more practical and convenient alternative to traditional charging methods. Beyond the convenience, they align with the shift toward electric fleets, helping businesses lower costs, streamline operations, and support broader environmental objectives.

How can fleet managers successfully transition to electric vehicles with Spiro or BasiGo models?

To make the shift to electric vehicles (EVs) a success, fleet managers should begin with a thorough assessment of their current operations and establish clear objectives for the transition. This means identifying the unique needs of their business, such as vehicle range, charging capabilities, and operational expenses. Companies like Spiro and BasiGo offer customized solutions to make this process more manageable.

Planning for charging infrastructure is another key step. Whether it’s upgrading existing facilities or building new ones, ensure they are compatible with the EV models you select. Introducing EVs gradually into your fleet can help ease the transition and limit any potential disruptions. At the same time, setting up a preventive maintenance program will help minimize downtime and keep operations running efficiently.

Collaborating with trusted providers like Spiro or BasiGo can bring valuable expertise in areas like infrastructure setup, employee training, and operational best practices. This strategy not only helps control costs but also aligns with sustainability goals while enhancing overall fleet performance.

Related posts

- SA EV Sales Growth 2025: Key Numbers

- Electric vs Petrol: Trends in South Africa

- Are South Africans Ready for the EV Revolution?

- Chinese EV brands gain momentum in South African market