Major European automakers and suppliers are announcing job cuts and cost-reduction measures amid slowing demand and a challenging economic outlook.

European Auto Industry Challenges: A Difficult Road Ahead

The European Auto Industry Challenges are mounting, with major automakers like Volkswagen and Stellantis facing significant headwinds. After a turbulent 2024, the outlook for 2025 remains uncertain, with cost-cutting measures, including job losses, becoming increasingly common.

A “Perfect Storm” of Challenges

Analysts at UBS Group describe the situation as an “almost perfect storm” for the industry. Key factors contributing to the downturn include:

- Pricing Pressure: Increased competition, particularly from Chinese manufacturers, is putting downward pressure on prices.

- Market Share Losses in China: European automakers are struggling to maintain their market share in the crucial Chinese market.

- Stricter CO2 Regulations: Tougher emissions regulations in Europe are forcing manufacturers to invest heavily in electric vehicle (EV) technology, even as EV demand growth slows.

- Tariff Risks: Potential trade disputes, particularly with the US under a potential new administration, could significantly impact exports.

- Weak Demand: Overall demand for new vehicles remains sluggish.

These combined pressures are eroding profits, forcing companies to implement drastic cost-reduction measures.

Major Job Cuts and Restructuring

The impact of these challenges is already evident in widespread job cuts and restructuring efforts:

- Volkswagen: VW is engaged in tense negotiations with its labor union, IG Metall, over significant cost-cutting measures, including potential factory closures in Germany. Management rejected a counter-proposal from the union, suggesting further conflict is likely. The company is struggling to compete, especially as it transitions to electric vehicles.

- Stellantis: Stellantis recently ousted its CEO, Carlos Tavares, highlighting the turmoil within the company.

- Ford: Ford plans to cut 14% of their European workforce.

- Suppliers: Major automotive suppliers like Robert Bosch, Continental, and ZF Friedrichshafen have announced a combined total of around 20,000 job cuts in Germany. Schaeffler plans to close two sites.

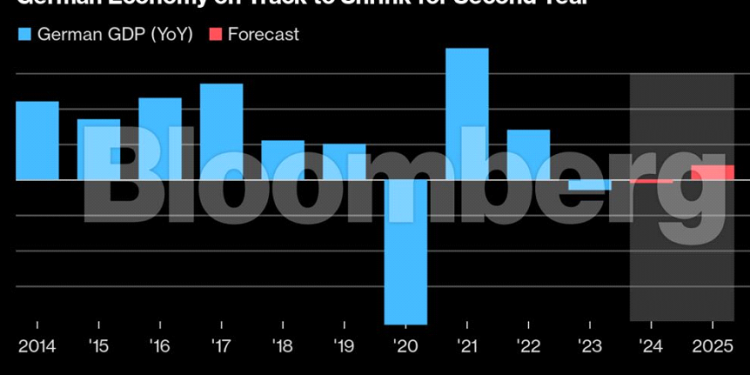

These job losses are a significant blow to the German economy, where the automotive sector is a major employer. The Federal Ministry for Economic Affairs and Climate Action (BMWK) (replace with a direct link if possible) is likely monitoring the situation closely. The overall economic outlook for Germany remains weak, with a shrinking manufacturing sector.

Stagnating EV Demand and Excess Capacity

The industry had been buoyed by strong order books following the COVID-19 pandemic and supply chain disruptions. However, those backlogs have now been cleared, and demand for EVs, in particular, is not growing as quickly as anticipated. This, combined with a failure to regain lost ground in China, has left carmakers with excess production capacity.

Uncertain Outlook

Even with company valuations significantly below historical averages, investors remain cautious. The timing of a sustained market rebound is unclear. The Ifo Institute, a leading German economic research center, reports that sentiment in the nation’s auto industry is “deteriorating rapidly.”

To understand the broader context, it can be helpful to stay updated on current car news. The Automotive Job Cuts are a major concern.

The challenges facing the European Auto Industry are substantial and multifaceted, requiring significant adaptation and restructuring to navigate the evolving market landscape.

Share Your Predictions

What long-term impact will these challenges have on the global automotive industry? Share your predictions below!