Kenya has become a leader in electric vehicle (EV) charging infrastructure in East Africa, offering valuable lessons for South Africa. Both countries face similar challenges in modernizing transportation while aiming for greener solutions. Kenya’s approach stands out due to its reliance on over 90% renewable energy, reduced taxes for EVs, and innovative battery-swapping systems. These strategies have fueled rapid market growth, with projections showing Kenya’s EV market growing from $0.05 billion in 2025 to $0.25 billion by 2030.

South Africa, meanwhile, is working on expanding its EV infrastructure but faces slower implementation due to complex regulations and higher costs. The country is aiming for 20% of new car sales to be electric by 2025 and has seen an 82.7% increase in EV sales in early 2024. Private and government investments are driving progress, with a focus on urban areas and advanced charging options. However, rural areas remain underserved.

Kenya’s model emphasizes speed and affordability, while South Africa’s approach focuses on detailed planning and premium features. Both strategies highlight different paths to building EV networks tailored to local needs.

Gov’t to deploy 10,000 EV charging units in the country by 2030

1. Kenya’s EV Charging Development

Kenya is making strides in building its EV charging infrastructure, thanks to strong government support and collaboration between public and private sectors. Policies like tax incentives, which make EVs more affordable, have played a key role in boosting consumer interest and encouraging investment in charging networks.

Public-private partnerships, supported by streamlined permit processes, have already expanded charging networks in major cities, with plans to reach rural areas as well. This cooperative approach has enabled a targeted rollout strategy that prioritizes both urban and underserved regions.

To meet the diverse needs of the market, Kenya has adopted a variety of technological solutions. In addition to standard plug-in charging stations, the country is introducing battery-swapping systems. These systems help reduce charging time, particularly benefiting commercial vehicle operators. By embracing this mix of technologies, Kenya is also finding ways to incorporate renewable energy into its charging infrastructure.

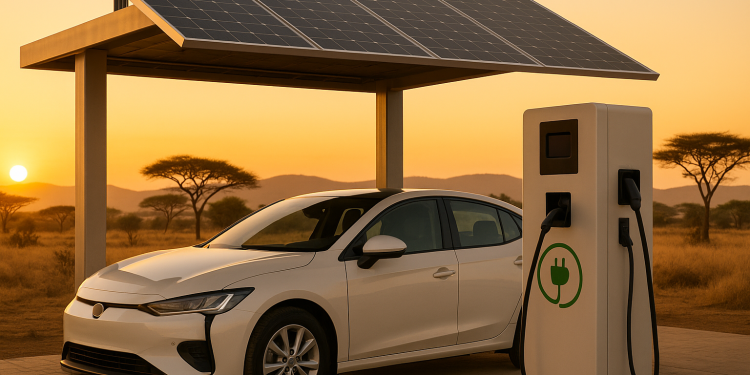

Addressing challenges like limited grid capacity in certain areas, Kenya is exploring innovative solutions. Mobile and solar-powered charging units are being tested, tapping into the nation’s abundant clean energy resources to provide sustainable options.

On top of technological advancements, Kenya is focusing on building local expertise to ensure the long-term success of its EV infrastructure. Partnerships with educational institutions are providing specialized training, creating a skilled workforce to support the growing sector. Looking ahead, future policies aim to encourage local manufacturing, expand charging networks, and create green jobs, further strengthening Kenya’s commitment to a sustainable future.

2. South Africa’s Current EV Infrastructure Plans

South Africa is making strides in developing its electric vehicle (EV) infrastructure through a mix of public and private investments, alongside clear government goals. One of its key targets is to have 20% of new car sales be electric by 2025. Inspired by regional successes, the country is working to implement similar strategies tailored to its needs.

The numbers tell a promising story. In the first quarter of 2024, EV sales jumped by an impressive 82.7%. Over 3,000 new energy vehicles were sold, compared to 1,665 during the same period the previous year. Hybrid vehicles dominated the market with over 2,500 units sold, while sales of fully electric cars rose from 232 to more than 330 units.

Private sector involvement is playing a crucial role in expanding the charging network. For instance, in November 2023, Mercedes-Benz committed R40 million to build 127 charging stations across the country.

Government initiatives are complementing these private investments. In May 2024, the Free State government teamed up with Zero Carbon Charge on a US$234 million project to expand charging networks across the province. These collaborations not only spread the financial risk but also bring in private sector expertise for smoother implementation.

Regulation is another cornerstone of South Africa’s EV strategy. The government is focusing on strategic placement of chargers and ensuring compatibility across various EV brands. The plan includes a mix of charging options – Level 1, Level 2, and DC fast chargers – to meet different needs, from overnight home charging to quick top-ups on highways.

The market outlook is optimistic. Projections suggest the South African EV market will grow at an annual rate of 18.6% between 2024 and 2028. This anticipated growth is fueling plans to extend charger networks beyond major urban centers, creating links between cities and rural areas.

Efforts to improve the user experience are also underway. These include introducing standardized payment systems, real-time charger availability tracking, and strategic charger placements. Additionally, scalable energy management systems are being developed to keep pace with the growing number of EV users, aligning South Africa’s efforts with global best practices.

sbb-itb-09752ea

Pros and Cons

Looking at Kenya’s and South Africa’s electric vehicle (EV) strategies reveals a mix of strengths and hurdles, each shaped by unique priorities and resources.

| Aspect | Kenya’s Approach | South Africa’s Approach |

|---|---|---|

| Advantages | – Quick rollout through flexible regulations and efficient partnerships. – Affordable solutions using locally designed technologies and creative financing. – Focus on rural connectivity ensures wide coverage from the start. | – Strong financial resources drive large-scale infrastructure projects. – Thoughtful planning includes a variety of chargers to meet different needs. – Public-private partnerships provide solid support. – Growing market interest signals momentum for EV adoption. |

| Disadvantages | – Limited funding compared to larger economies. – Urban infrastructure may lag behind demand. – Fewer advanced charging options available. – Scaling up could become a challenge as the network expands. | – Slower implementation due to complex regulations and stakeholder coordination. – Initial focus on urban areas may leave rural regions underserved. – Higher costs tied to advanced technology and detailed planning. – Regulatory hurdles could slow future growth. |

These contrasts shed light on how each country navigates user needs and geographical challenges.

Kenya’s strategy prioritizes speed, aiming to establish a basic infrastructure quickly and refine it over time. This approach focuses on affordability and accessibility, especially for rural areas, making it well-suited for a developing market. On the other hand, South Africa takes a more deliberate path, emphasizing thorough planning and premium features like real-time tracking and seamless payment systems, which leverage its stronger financial base.

Kenya’s model is tailored to its dispersed population, ensuring broader coverage, while South Africa’s urban-centric approach might initially overlook rural connectivity. In terms of financial sustainability, Kenya’s cost-effective model aligns with its market realities, whereas South Africa’s higher investment could deliver better long-term returns if adoption meets expectations.

Both strategies offer valuable insights into designing EV infrastructure that meets local needs, highlighting how different priorities shape the path forward for electric mobility.

Conclusion

Kenya’s journey in building EV charging infrastructure provides South Africa with a practical blueprint – one that emphasizes speed without compromising on functionality. By adopting agile strategies, South Africa can create momentum in its emerging EV market.

A key takeaway from Kenya’s success is its partnership-driven approach. South African planners could simplify approval processes and introduce fast-track options for private sector participation. Instead of waiting for fully developed regulatory frameworks, launching pilot programs in cities like Cape Town and Johannesburg could provide valuable insights and foster trust among stakeholders.

Equally important is ensuring rural areas are not left behind. While focusing on urban centers makes sense from a business standpoint, neglecting rural regions could lead to an imbalanced EV ecosystem. Kenya’s simultaneous urban and rural deployment strategy, even with basic charging setups in remote areas, offers a more inclusive model. This approach not only broadens access but also helps manage costs effectively.

A tiered charging system could work well for South Africa – offering high-end stations in cities while providing simpler, cost-effective solutions for rural areas. This mix ensures wider coverage without overstretching resources.

Given the significant investment required, careful oversight is crucial. Kenya’s example highlights the value of incremental progress, where smaller, manageable improvements often outperform costly, large-scale launches that may face scaling challenges.

For South Africa, the priority should be on quick deployment during the early stages. Kenya has shown that rapid infrastructure rollouts can attract investment and fuel innovation. The ultimate goal should be to establish a functional and adaptable EV network that grows alongside user demand and regional needs.

FAQs

How does Kenya’s use of renewable energy support its EV charging network?

Kenya’s strong focus on renewable energy, especially geothermal and solar power, is a game-changer for its electric vehicle (EV) charging network. With nearly 90% of the country’s electricity coming from clean energy, its charging stations operate with minimal environmental impact, cutting down greenhouse gas emissions in the process.

This strategy not only trims costs by reducing reliance on fossil fuels but also makes EVs a more appealing and eco-friendly choice for transportation. Kenya’s efforts highlight how blending renewable energy with EV infrastructure can offer a practical solution for other nations, like South Africa, to tackle energy and transportation hurdles while advancing toward a cleaner future.

What challenges does South Africa face in building its EV charging network compared to Kenya?

South Africa is grappling with notable hurdles in establishing its EV charging network, and a major issue is the unreliable electricity grid. Regular power outages pose a serious challenge to maintaining dependable charging stations, which are essential for encouraging more people to switch to electric vehicles.

On top of that, the steep initial costs of EVs and charging infrastructure, coupled with minimal government incentives and policy backing, are slowing down progress. Meanwhile, Kenya has made strides by introducing focused policies and building strategic partnerships – an approach South Africa could consider adapting to tackle its own set of challenges.

How can South Africa ensure EV charging stations are accessible in both cities and rural areas?

To expand EV charging access throughout South Africa, a tiered infrastructure strategy could be the answer. In bustling urban areas, fast-charging stations would cater to the high volume of vehicles, offering quick and efficient service for drivers on the go. Meanwhile, in rural or sparsely populated regions, slower, more cost-effective chargers could be installed to ensure broader coverage without breaking the bank.

This approach strikes a balance between affordability and accessibility, ensuring that all parts of the country – whether densely populated cities or remote towns – are equipped to support the growth of electric vehicles. By taking a page from Kenya’s playbook and adapting those insights to South Africa’s specific challenges, planners can design a system that meets the needs of both city drivers and rural communities.

Related posts

- SA EV Sales Growth 2025: Key Numbers

- EV Buyers in South Africa: Emissions and Behavior

- SA’s First Solar EV Charging Stations: What to Know

- Are South Africans Ready for the EV Revolution?