Car insurance in South Africa isn’t mandatory, but with over 800,000 annual road accidents and rising hijacking rates, it’s crucial for financial protection. About 60-70% of vehicles remain uninsured, leaving many drivers at risk of covering hefty repair and medical costs themselves. This guide ranks the top car insurers in South Africa for 2025, focusing on coverage, pricing, customer service, and claims handling.

- Santam: Offers tiered plans for different budgets, strong claims support, and premium service for high-net-worth clients. Higher premiums compared to competitors.

- OUTsurance: Transparent pricing, excellent customer service, and safe-driving rewards. Limited branch availability.

- Discovery Insure: Rewards safe driving through telematics and offers digital tools. Complex rewards system and privacy concerns.

- Auto & General: Affordable with cashback rewards and straightforward policies. Fewer perks and premium options.

- King Price Insurance: Unique decreasing premiums model, saving money as your car depreciates. Limited physical presence and shorter track record.

- MiWay: Digital-first approach with flexible policies and usage-based insurance. Less suitable for those preferring in-person support.

Quick Comparison

| Company | Strengths | Weaknesses |

|---|---|---|

| Santam | Reliable, tiered plans, strong claims support | High premiums, slower processes |

| OUTsurance | Transparent pricing, great service | Limited branches, fewer coverage options |

| Discovery Insure | Rewards safe driving, digital tools | Complex system, privacy concerns |

| Auto & General | Affordable, cashback rewards | Fewer extras, limited premium options |

| King Price | Decreasing premiums, simple pricing | Short track record, minimal branches |

| MiWay | Digital focus, flexible policies | Limited in-person support |

Choose based on your budget, driving habits, and coverage needs. Whether you prioritize affordability, digital tools, or premium service, this ranking highlights the best options for South African drivers in 2025.

The Truth About Car Insurance In South Africa

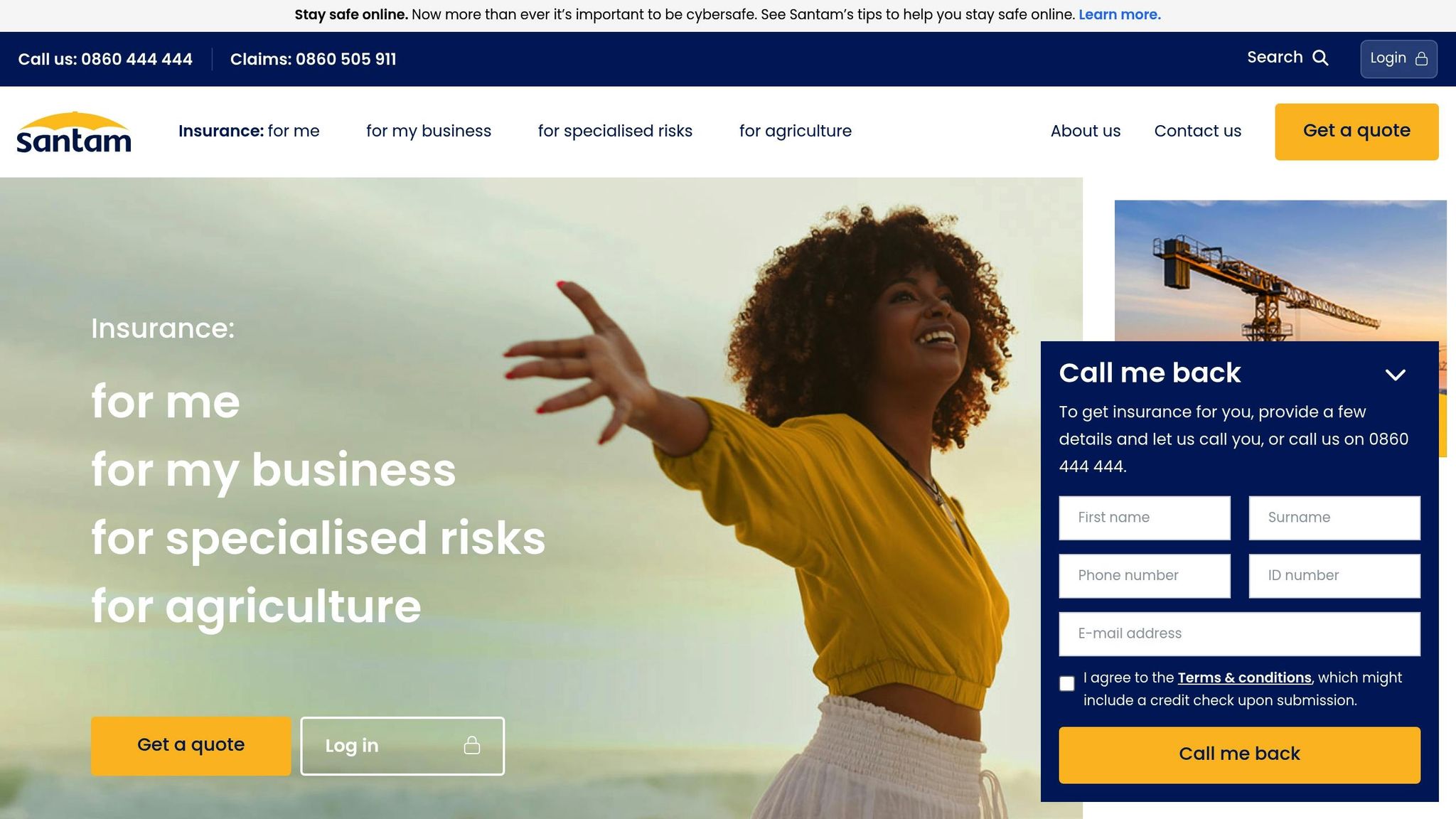

1. Santam

Santam, South Africa’s oldest short-term insurer, brings a wealth of experience to car insurance. With a blend of proven reliability and modern convenience, it stands out as a dependable choice for drivers seeking comprehensive coverage.

Coverage Options

Santam offers three distinct tiers of car insurance – Core, Classic, and Executive – designed to meet different budgets and coverage needs.

- Core: This is the most budget-friendly option, ideal for new drivers looking for essential coverage. It provides basic comprehensive insurance with optional extras available at competitive rates.

- Classic: The most popular choice, this tier offers enhanced comprehensive coverage tailored for more established clients. It includes higher limits and additional optional benefits compared to Core.

- Executive: Designed for high-net-worth individuals, this premium tier delivers customized comprehensive coverage. It features worldwide cover, extended limits, and access to dedicated claims and service consultants.

Here’s a quick comparison of some key benefits across the three tiers:

| Feature | Core | Classic | Executive |

|---|---|---|---|

| Vehicle keys | R1,000 | R5,000 | R15,000 |

| Emergency repairs, costs, and accommodation | R5,000 | R15,000 | R15,000 |

| Tow-in costs after mechanical breakdown and recovery costs | R1,000 | R3,500 | R3,500 |

| Emergency expenses of passengers (non-family) | R3,000 | R3,000 | R5,000 |

| Emergency expenses of passengers (family) | R3,000 | R20,000 | R25,000 |

| Trauma treatment | R5,000 | R10,000 | R10,000 |

Santam also offers the SmartPark™ program, which provides up to a 20% discount on premiums for drivers who travel less than 15,000 km (about 9,320 miles) annually. This is a great option for those who work from home or use a company vehicle regularly.

Affordability

Santam’s premiums are on the higher side compared to other insurers in South Africa. Monthly costs for comprehensive coverage typically range from R1,661 to R2,489, with an excess fee of around R5,000 per claim. These prices reflect the company’s focus on delivering extensive coverage and personalized service.

The Executive solution employs scientific risk assessments to offer competitive, tailored rates. Additionally, the SmartPark™ discount can make coverage more affordable for low-mileage drivers, and bundling multiple policies may lead to further savings.

Customer Service

Santam places a strong emphasis on personalized service, particularly for its higher-tier customers. Executive policyholders gain access to dedicated claims and service consultants, ensuring top-notch support when it matters most. Across all tiers, the insurer offers 24/7 emergency roadside assistance, providing peace of mind during unexpected situations.

Unlike some tech-driven insurers that prioritize instant online sign-ups, Santam focuses on thorough consultations and tailored solutions.

Claims Process

Santam has earned a solid reputation for efficient claims handling and fair payouts. Its long history in the industry ensures a well-established system for managing claims.

For Executive solution customers, the claims process includes personalized support, ensuring that high-value claims are handled with care and expertise. This tier also offers car hire for up to 30 days during repairs, helping clients maintain their mobility without disruption.

Santam’s financial strength further ensures its ability to handle claims effectively, even during challenging economic times.

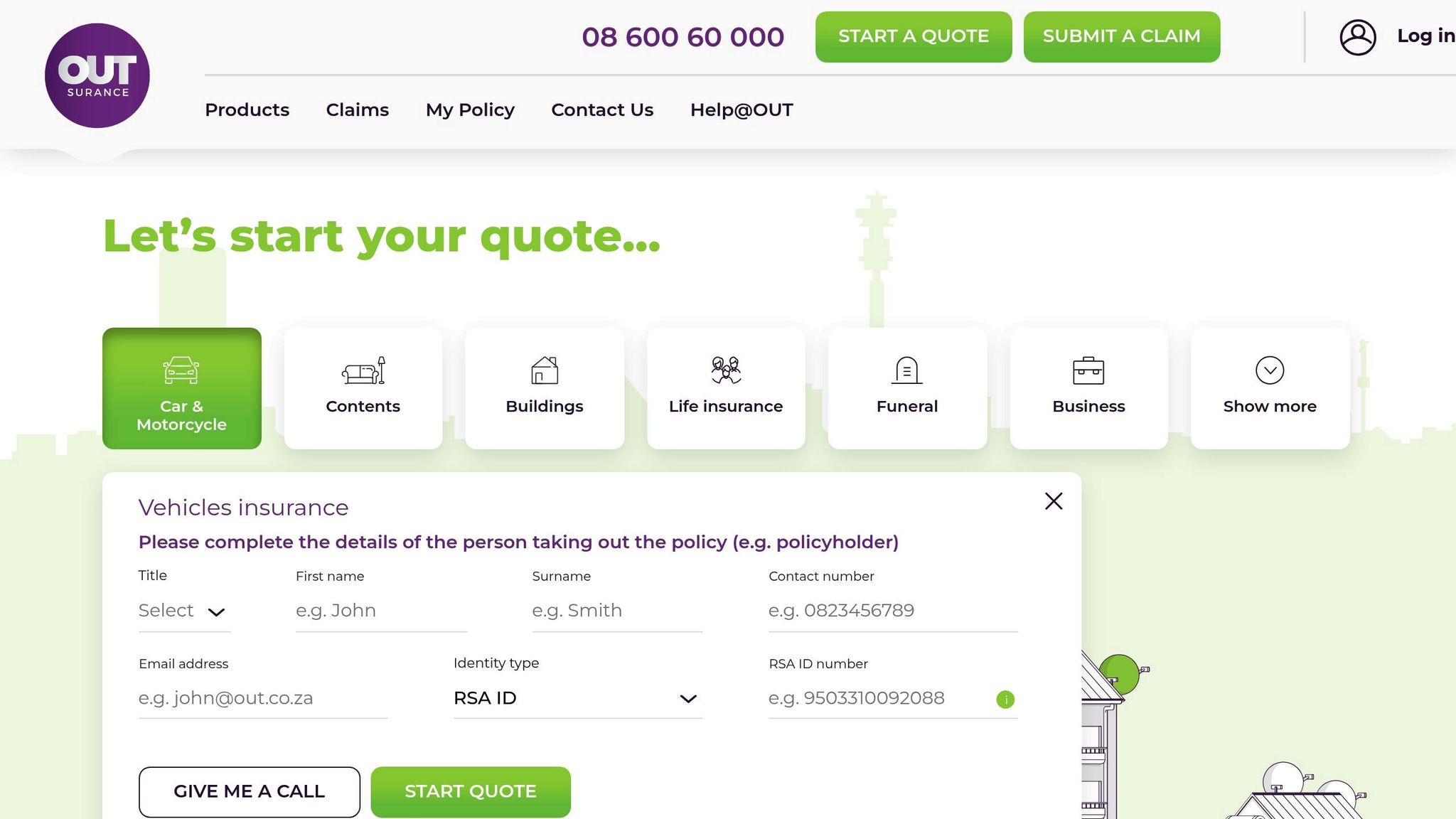

2. OUTsurance

OUTsurance is a customer-focused insurer that keeps things simple with easy-to-understand policies and competitive pricing. Positioned as a value-driven choice in the car insurance market, it combines affordability with flexible coverage options.

Coverage Options

OUTsurance provides comprehensive car insurance that covers accident damage, theft, hijacking, and third-party liability. Policyholders can enhance their plans with optional add-ons like extended vehicle hire, personal accident benefits, and increased emergency expense limits. The SmartDrive telematics program is another standout feature, rewarding safe driving habits with incentives.

For those looking for a more basic plan, OUTsurance also offers third-party insurance to meet legal requirements without breaking the bank.

Affordability

OUTsurance strikes a balance between essential coverage and budget-friendly pricing. Monthly premiums are affordable, and excess fees remain reasonable. The company’s no-claims bonus system further rewards safe drivers by reducing premiums for those who avoid accidents. Plus, its claims policy is designed to be forgiving, ensuring that a single incident doesn’t lead to steep penalties.

Customer Service

OUTsurance takes customer service seriously. Their call center operates 24/7, so help is always just a phone call away. They also embrace a digital-first approach with a user-friendly mobile app. Through the app, customers can manage policies, file claims, and request roadside assistance effortlessly. Speaking of assistance, their 24/7 roadside service is a highlight, covering everything from jump-starting a dead battery to changing a flat tire or arranging emergency towing.

Claims Process

Filing a claim with OUTsurance is quick and hassle-free. Customers can submit claims using the mobile app, website, or by phone. For minor claims, the process is even more convenient, as photo submissions through the app often eliminate the need for in-person inspections. OUTsurance works with an extensive network of approved repair partners in major cities, ensuring easy access to quality repairs. They also closely monitor the repair process from start to finish. Whenever possible, the company prioritizes repairs over declaring a total loss, helping customers keep their vehicles on the road and minimizing disruption.

3. Discovery Insure

Discovery Insure combines wellness incentives and telematics to create customized premiums and rewards. Drawing on its parent company’s expertise in health and wellness, the insurer also encourages safer driving habits.

Coverage Options

Discovery Insure provides comprehensive coverage that includes accident damage, theft, and third-party liability. One standout feature is the DQ-Track telematics device, which tracks driving behavior to influence pricing and rewards. They offer a variety of plans, from standard policies to options tailored for high-value or classic cars. Through the Vitality Drive program, safe drivers can earn rewards that can be used for related benefits. This approach not only promotes safer driving but also offers competitive pricing for those who drive responsibly.

Affordability

Safe driving is rewarded with reduced premiums over time, thanks to telematics monitoring. Households with multiple vehicles can also enjoy discounts, making it a cost-effective choice for families. This pricing model encourages careful driving while offering financial incentives.

Customer Service

Discovery Insure prioritizes digital convenience, allowing policyholders to manage their accounts, track performance, and file claims online. For added support, they provide 24/7 customer service, including round-the-clock roadside assistance. Services like tire changes, emergency fuel delivery, and towing are just a call away, ensuring help is always accessible.

Claims Process

The claims process is designed to be quick and tech-friendly. With telematics, accidents can be reported instantly, and claims are easily submitted through the app, website, or by phone. Discovery Insure partners with an approved network of repair facilities to ensure timely repairs and resolutions, streamlining the entire experience for policyholders.

4. Auto & General

Auto & General stands out for its extensive coverage options and strong customer support. The company was ranked first in Forbes/Statista’s 2024 "World’s Best Auto Insurers" list for South Africa.

Coverage Options

Auto & General provides a range of comprehensive coverage plans designed to meet individual needs. Standard policies typically include protection against accident damage, theft, hijacking, and third-party liability. What sets them apart is their focus on customization, allowing policyholders to adjust coverage based on personal requirements and risk factors. One standout feature is the "Young@Heart" benefit for members over 50, which includes spouse coverage and the option to waive basic excesses.

Affordability

While Auto & General might not always offer the lowest upfront premiums, it prioritizes delivering value through dependable service and solid coverage. The company balances affordability with quality by offering cashback rewards to loyal customers, which can help reduce overall costs over time.

Customer Service

Auto & General has earned a customer rating of 4.22/5 from more than 21,000 reviews on Hellopeter.

"Auto & General leads in customer ratings", according to My Debt Hero.

Their commitment to excellent service extends across the entire policy lifecycle, with a focus on providing timely support and assistance whenever needed.

Claims Process

The claims process with Auto & General is designed for efficiency. Around 50% of claims are auto-settled, ensuring quicker resolutions.

"Auto & General offers comprehensive coverage tailored to your needs, with an emphasis on hassle-free claim processing", notes Hippo.

For approved claims, payments are made immediately. Dedicated claims consultants guide customers through the process, and claims can be submitted and tracked via the mobile app or online platform, which are available 24/7 for added convenience.

sbb-itb-09752ea

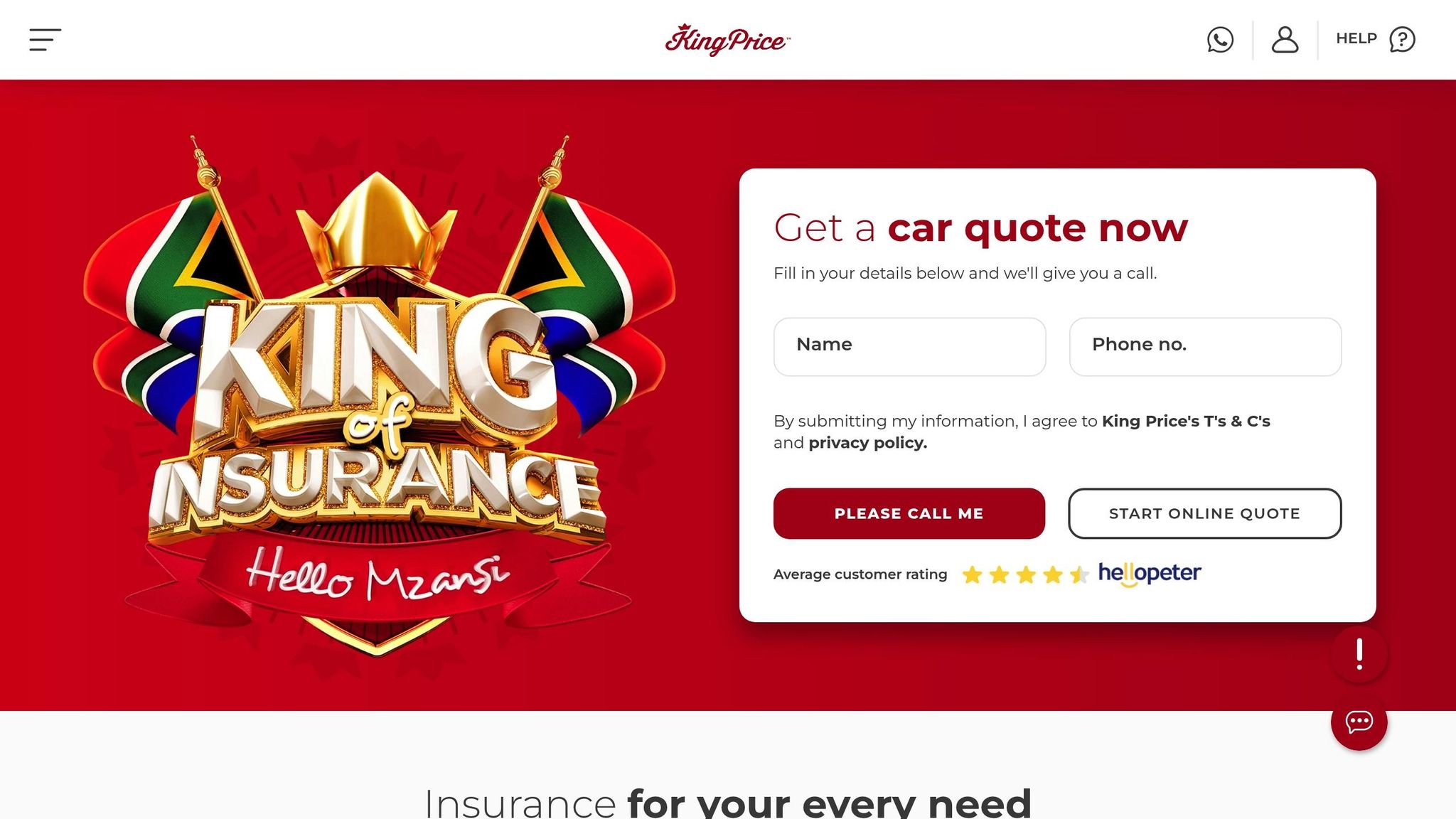

5. King Price Insurance

King Price Insurance stands out with its unique approach to car insurance – offering a decreasing premium model. As the only insurer globally to reduce monthly premiums in line with your car’s depreciation, it has saved clients a whopping R140 million (about $9.3 million) in premiums so far.

Coverage Options

King Price provides five car insurance options to suit different needs: Agreed Value, Comprehensive, Theft and Write-off, Third Party Fire and Theft, and Third Party Only [22, 24].

- The Agreed Value option locks in a fixed insured value for three years, so you don’t have to worry about depreciation affecting your payout.

- With the Comprehensive policy, you can add coverage for portable items – like bicycles, golf clubs, hearing aids, or motorbike gear – for just R1 per month [24, 29].

- It also includes 24/7 Emergency Assist for both medical and mechanical emergencies, giving you peace of mind whenever you’re on the road [21, 23].

These tailored options, combined with the company’s decreasing premium structure, offer flexibility and financial benefits.

Affordability

King Price’s model is perfect for drivers looking to save money. Since premiums shrink as your car’s value drops, you can enjoy consistent savings over time [28, 29]. Additional ways to save include:

- Multi-car discounts and bundling policies [24, 26, 30].

- Zero basic excess for drivers over 45.

- Low-mileage discounts for those driving less than 9,320 miles (15,000 km) annually [26, 29].

- Reduced premiums by choosing a higher excess, parking securely, or adding extra security features.

For 2025, estimated costs for third-party insurance range from R200 to R500 per month (about $13–$33), while comprehensive coverage is priced between R800 and R2,000 per month (around $53–$133).

Customer Service

King Price has earned a strong reputation for customer satisfaction, with a 4.66-star rating on HelloPeter based on thousands of verified reviews. Its commitment to clear communication and delivering value has made it a trusted choice for South African drivers.

Claims Process

Handling claims is a major focus for King Price. As of June 2025, the company pays out over R7 million (approximately $470K) in claims daily. Its 24/7 Emergency Assist ensures quick support in urgent situations, maintaining a smooth and efficient claims process from start to finish. This dedication to service ensures drivers feel supported when they need it most.

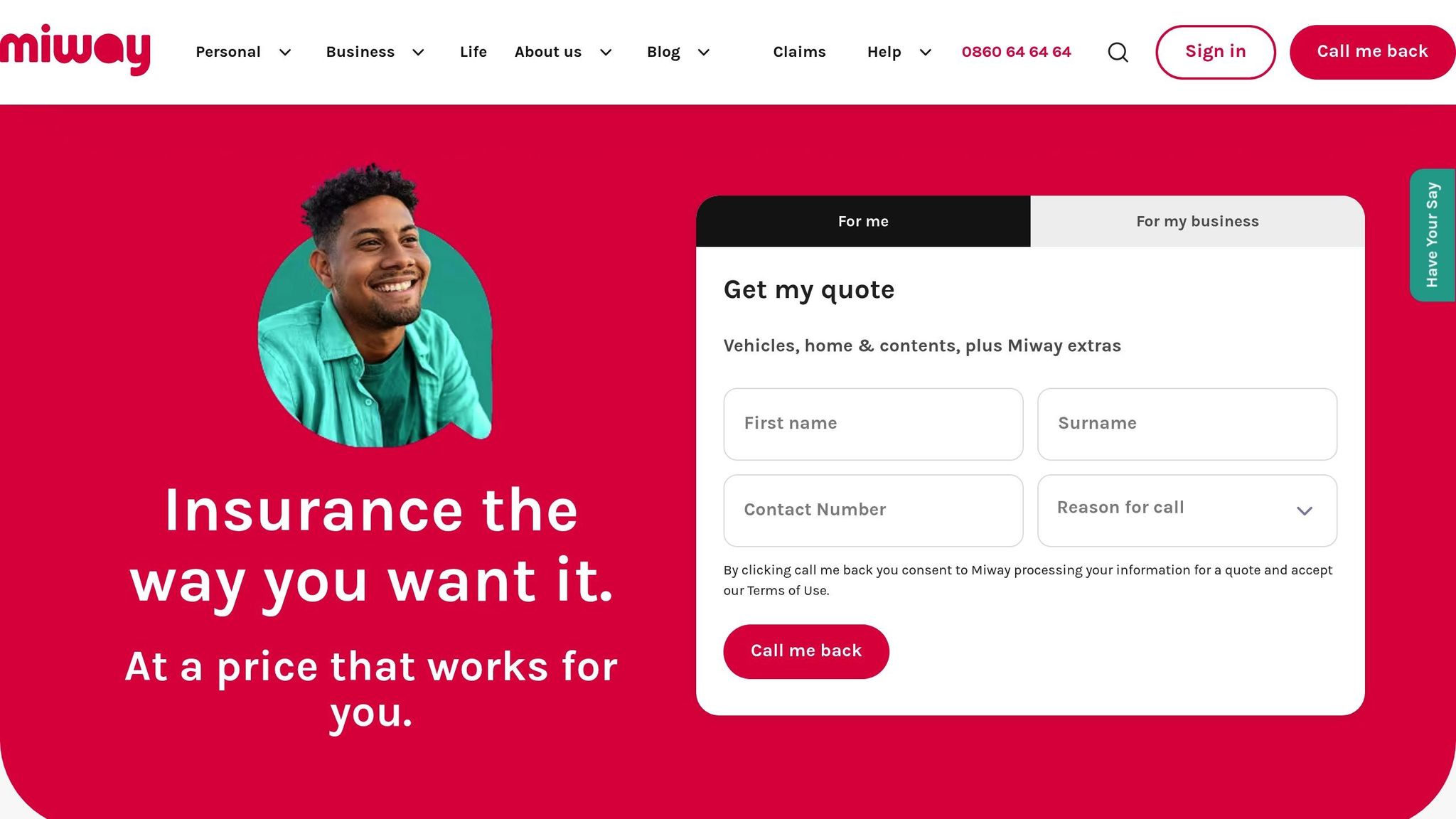

6. MiWay

MiWay uses technology to make insurance simple and tailored to individual needs. They focus on providing coverage options that suit South African drivers, all while keeping their pricing competitive.

Coverage Options

MiWay offers a variety of car insurance plans designed for different needs. Their comprehensive policy covers accident damage, theft, hijacking, and third-party liability. For those looking for more budget-friendly options, they provide Third Party Fire and Theft or Third Party Only coverage.

Some standout features of their policies include flexible excess options, emergency roadside assistance, and access to a trusted network of repair facilities. They also offer a usage-based insurance option that uses telematics technology, potentially rewarding safe drivers with lower premiums. These options are designed to give drivers flexibility without sacrificing affordability.

Affordability

MiWay keeps its pricing transparent, basing premiums on the vehicle’s value and the driver’s profile. They also offer discounts, such as savings for bundling multiple policies, a no-claims bonus for safe drivers, and incentives for customers who manage their policies online.

Customer Service

MiWay’s customer service is built around convenience and digital accessibility. Their website and mobile app provide 24/7 support, allowing policyholders to manage claims, update policy information, or access emergency services. These features are particularly appealing to tech-savvy users who value efficiency.

Claims Process

MiWay simplifies the claims process through its digital platform. Customers can file claims online by uploading photos and necessary documents through the website or app. They also partner with a network of trusted repairers in major cities, ensuring quality service is always nearby. Regular updates via SMS and email keep customers informed, and services like emergency glass replacement help reduce the hassle during repairs.

Pros and Cons Comparison

Here’s a side-by-side look at the strengths and weaknesses of each insurer reviewed earlier. This table highlights key points about coverage, pricing, service, and claims to help you weigh your options.

| Company | Pros | Cons |

|---|---|---|

| Santam | • Wide-reaching nationwide network • Strong financial stability with years of experience • Broad range of coverage options, including specialized policies • 24/7 claims support via dedicated hotlines | • Premiums tend to be higher than newer competitors • Slower, traditional processes • Lacks cutting-edge digital features compared to tech-driven providers |

| OUTsurance | • Transparent pricing with no hidden costs • Excellent customer service ratings • Quick claims processing • Focused on customer satisfaction and loyalty | • Fewer coverage options compared to traditional insurers • Limited physical branch availability • Not ideal for those who prefer face-to-face service |

| Discovery Insure | • Advanced telematics technology with DriveSense • Vitality rewards program offering practical perks • Risk assessment driven by data • Modern digital tools, including a mobile app | • Rewards system can be overly complex • Higher premiums for drivers less engaged with tech features • Privacy concerns due to extensive data collection |

| Auto & General | • Affordable pricing for budget-conscious drivers • Straightforward and easy-to-understand policies • Quick online quote process • Great option for basic coverage needs | • Limited premium coverage options • Fewer extra perks compared to comprehensive providers • Customer service may not match premium insurers |

| King Price Insurance | • Unique decreasing premium model that saves money over time • Clear and simple pricing structure • Positive customer service feedback • Fresh approach to traditional insurance practices | • Shorter track record as a newer company • Minimal physical branch presence • May not appeal to those who prefer long-established insurers |

| MiWay | • Robust digital platform with 24/7 online support • Flexible excess options and customizable policies • Usage-based insurance tailored to safe drivers • Transparent pricing with online discounts | • Limited physical branch network • Less suitable for customers who prefer phone-based support • Relatively newer in the market compared to older competitors |

Santam stands out for its reliability and extensive reach, though it comes at a higher price. On the other hand, tech-savvy insurers like Discovery Insure and MiWay cater to drivers looking for modern features and competitive pricing but may feel overwhelming for those who prefer simplicity.

For budget-conscious drivers, Auto & General and King Price Insurance provide affordable options without unnecessary extras. Meanwhile, those prioritizing premium service and comprehensive coverage may find Santam or OUTsurance to be a better fit. This breakdown sets the foundation for the upcoming conclusion.

Conclusion

Choosing the right insurer comes down to finding the one that fits your specific needs. Our 2025 rankings highlight that no single company dominates across all categories, so your choice should revolve around key factors like coverage options, affordability, customer service, and claims efficiency.

Each provider has its strengths. Santam remains a reliable option for drivers seeking comprehensive coverage, though its higher premiums reflect the level of protection it offers.

For those prioritizing affordability, Auto & General and King Price Insurance are excellent options. Auto & General provides straightforward policies tailored to essential coverage needs, while King Price stands out with competitive pricing that could lead to long-term savings.

If you’re a tech-savvy driver, consider Discovery Insure for its telematics rewards or MiWay, which offers 24/7 digital support and flexible policy options.

OUTsurance, on the other hand, is a great pick for its standout customer service and transparent pricing.

Ultimately, your decision should align with your budget, driving habits, and coverage priorities. Whether you opt for the established reputation of Santam or the forward-thinking approach of King Price, ensure your choice meets both your current needs and future expectations.

These insights are here to help guide you toward the best decision for your circumstances.

FAQs

What should I look for when choosing car insurance in South Africa?

When choosing car insurance in South Africa, it’s important to weigh coverage options, cost, and the insurer’s track record for customer service and claims handling. While price is a key factor, don’t stop there – think about deductibles, policy limits, and any discounts you might qualify for.

Your driving history, age, type of car, and driving habits also play a big role in determining premiums and finding the right policy. Taking the time to compare several insurers and reviewing the benefits they offer can help you pick a plan that fits your needs.

How does King Price Insurance’s decreasing premium model work, and what are its advantages?

King Price Insurance stands out with its decreasing premium model, a system where your car insurance costs drop as your vehicle’s value declines over time. This means you’re not stuck paying the same high premiums for a car that’s losing value each year.

Here’s why this model makes sense:

- Save money: Your payments shrink as your car depreciates.

- Fair pricing: Premiums match your car’s current worth, so you’re not overpaying.

- Clear and logical: The pricing structure is easy to understand and feels reasonable compared to fixed-rate premiums.

This model is perfect for those who want a cost-effective insurance plan that adjusts to the real value of their car.

What privacy concerns should I be aware of when using telematics-based car insurance programs like those from Discovery Insure?

Telematics-based car insurance programs, like those from Discovery Insure, often spark privacy concerns because of the detailed information they gather. These systems track things like your location, speed, and driving habits, which can leave some drivers feeling uneasy about how their data might be used.

Although South Africa’s Protection of Personal Information Act (POPIA) requires insurers to be upfront, secure consent, and protect your data, doubts still linger. Drivers may fear scenarios where their data is misused – whether it’s shared without approval or leveraged against them in disputes. That’s why it’s crucial to carefully review the insurer’s privacy policies and make sure you’re comfortable with how your information will be managed before enrolling in such a program.

Related Blog Posts

- Top 5 Cars for South African Roads

- Car insurance prices in South Africa

- Top 7 Cars with the Cheapest Insurance Rates in South Africa

- Comprehensive car insurance in South Africa: What you need to know in 2025